As rental investors and landlords, it’s essential to have access to flexible financing options to maintain and improve your investment properties. With the relentless rising costs of property maintenance and the financial limitations of refinancing a home, many homeowners are feeling the pressure of keeping their investments afloat. One option to combat the rising costs of maintenance is a Home Equity Line of Credit (HELOC).

In this guide, we’ll explore the ins and outs of HELOCs, how they work, and how they can benefit rental investors and landlords. Whether you’re looking to fund property repairs or expand your real estate portfolio, understanding HELOCs can be a valuable tool in your financial arsenal.

Calculate Your Market Rental Rate

Price your property too high and you’ll face long periods of vacancy. Price your property too low and you’ll set yourself up for years of loss.

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit, commonly referred to as a HELOC, is a revolving credit line that allows homeowners to borrow against the equity they’ve built in their properties. It works similarly to a credit card, where you have access to a predetermined credit limit and can borrow as needed. The credit line is secured by the value of your home, making it a lower-risk option for lenders and offering potentially more favorable interest rates compared to unsecured forms of credit.

How Does a HELOC Work?

A HELOC has two main phases: the draw period and the repayment period. During the draw period, which typically lasts around 10 to 15 years, you can access funds from your credit line as needed. You can use these funds for various purposes, such as property repairs, renovations, or even acquiring additional investment properties.

Unlike traditional installment loans, where you receive a lump sum upfront, a HELOC allows you to borrow funds on an ongoing basis. As you borrow from your credit line, you are only required to make interest payments on the amount you’ve used. This flexibility allows you to manage your cash flow efficiently and borrow funds as circumstances require.

Once the draw period ends, the repayment period begins. During this phase, which typically lasts 20 years, you can no longer withdraw funds from your credit line, and you must start repaying both the principal and interest on the amount borrowed. Monthly payments are typically higher during the repayment period compared to the draw period, as they include both principal and interest.

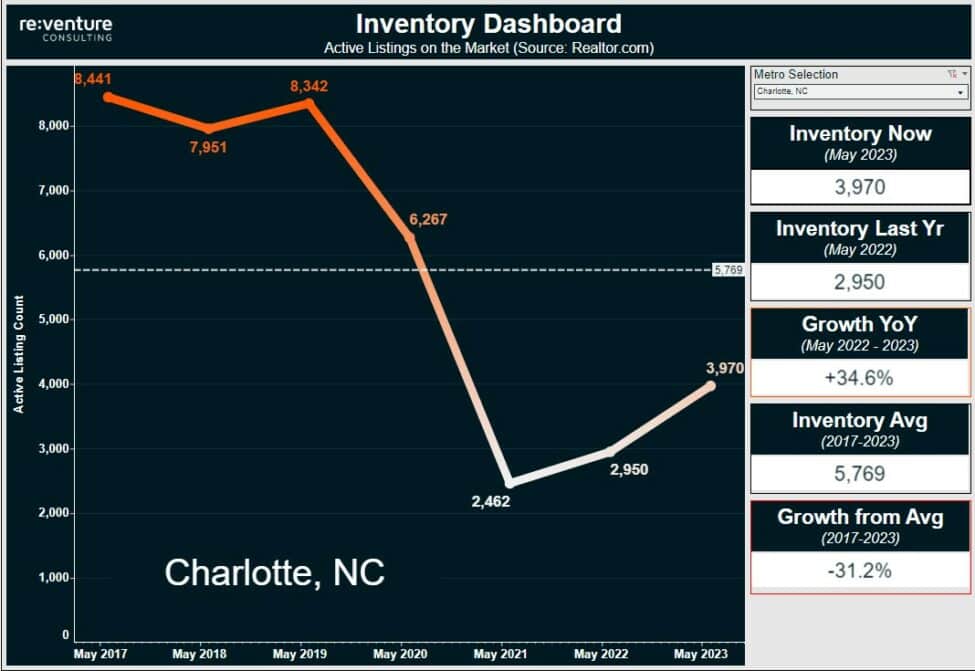

When will the housing market crash?

Supply/demand, zoning regulations, labor shortages. Is this all contributing to a housing market crash?

Qualifying for a HELOC

To qualify for a HELOC, lenders will consider several factors, including your credit score, equity in the property, debt-to-income ratio, and income history. Most lenders require a minimum FICO score of 660 or higher to be eligible for a HELOC. Your equity in the property is determined by subtracting the amount you owe on your mortgage from the current market value of the property. Lenders generally require a significant amount of equity, often around 15% or more, to approve a HELOC.

Additionally, lenders will assess your debt-to-income ratio, which compares your monthly debt payments to your monthly income. A lower debt-to-income ratio indicates a lower level of financial risk and may increase your chances of qualifying for a HELOC. Finally, lenders will review your income history to ensure you have a stable source of income to meet the repayment obligations.

Benefits of a HELOC for Rental Investors and Landlords

1. Flexibility in Financing Property Expenses

One of the primary benefits of a HELOC for rental investors and landlords is the flexibility it offers in financing property expenses. Whether you need to cover unexpected repairs, fund renovations to attract tenants, or acquire new investment properties, a HELOC provides quick access to funds. Instead of going through the lengthy process of applying for a traditional loan, you can tap into your HELOC as needed, making it a convenient option for managing your investment properties.

2. Lower Interest Rates and Tax Deductibility

HELOCs often come with lower interest rates compared to other forms of credit, such as personal loans or credit cards. The interest rates on a HELOC are typically variable, meaning they can fluctuate based on market conditions. However, even with potential rate changes, they tend to be more favorable than unsecured forms of credit. Additionally, the interest paid on a HELOC may be tax deductible, subject to certain conditions. It’s essential to consult with a tax advisor to understand the specific tax implications based on your individual circumstances.

3. Potential for Property Appreciation

By using a HELOC to fund property improvements or acquire additional investment properties, rental investors and landlords have the opportunity to leverage potential property appreciation. Improving and maintaining the quality of your properties can increase their value over time, allowing you to potentially realize greater returns on your investment. With a HELOC, you can strategically invest in your properties to maximize their long-term value.

4. Access to Emergency Funds

Owning and managing rental properties comes with unforeseen expenses and emergencies. A HELOC can serve as a valuable source of emergency funds, providing a financial safety net for unexpected repairs or vacancies. Having access to readily available funds through a HELOC can help you navigate challenging situations without disrupting your cash flow or jeopardizing the upkeep of your investment properties.

How Soon Should I List My Rental Property?

Offering a shorter lease may save your investment for years to come.

How to Use a HELOC for Rental Properties

As a rental investor or landlord, there are several ways you can utilize a HELOC to benefit your investment properties. Here are some common scenarios where a HELOC can be advantageous:

1. Property Repairs and Maintenance

Maintaining your investment properties is crucial for attracting and retaining tenants. A HELOC can be used to cover the costs of property repairs, such as fixing plumbing issues, replacing appliances, or addressing structural damages. By using a HELOC for property maintenance, you can ensure that your properties remain in excellent condition, minimizing tenant turnover and maximizing rental income.

2. Renovations and Upgrades

Investing in property renovations and upgrades can significantly enhance the value and appeal of your rental properties. Whether it’s updating kitchen appliances, remodeling bathrooms, or adding attractive landscaping, a HELOC can provide the necessary funds to undertake these projects. By improving the aesthetics and functionality of your properties, you can attract higher-quality tenants and potentially command higher rental rates, ultimately boosting your rental income.

3. Acquiring Additional Investment Properties

Expanding your real estate portfolio often requires access to substantial capital. A HELOC can be an effective tool for financing the acquisition of new investment properties. By leveraging the equity in your existing properties, you can access funds to make down payments or cover the costs associated with purchasing additional rental properties. This strategy allows you to diversify your portfolio and potentially increase your rental income streams.

4. Cash Flow Management

Managing the cash flow of your rental properties can be challenging, especially during periods of vacancy or unexpected expenses. A HELOC can serve as a buffer to cover temporary cash flow gaps, ensuring that you can meet your financial obligations, such as mortgage payments and property taxes. By utilizing a HELOC strategically, you can stabilize cash flow and maintain the financial health of your investment properties.

Conclusion

As a rental investor or landlord, a Home Equity Line of Credit (HELOC) can be a valuable tool for financing and maintaining your investment properties. With its flexible access to funds, potentially lower interest rates, and the ability to leverage property appreciation, a HELOC offers numerous benefits. By utilizing a HELOC strategically, you can effectively manage property expenses, fund renovations, acquire additional properties, and maintain cash flow stability. However, it’s crucial to carefully evaluate your financial situation and consult with a trusted advisor to ensure that a HELOC aligns with your investment goals and risk tolerance. With proper planning and responsible utilization, a HELOC can be a powerful financial resource for rental investors and landlords.

Disclaimer: This article is for informational purposes only and should not be considered as financial or investment advice. Please consult with a qualified professional for personalized advice related to your specific financial situation.