The housing market has always been a topic of great interest and speculation. Homeowners, buyers, and sellers are constantly monitoring its trends, trying to predict the future and make informed decisions. One particular concern that often arises is the possibility of a housing market crash. In this article, we will analyze the different viewpoints and predictions surrounding this topic, debunking myths and shedding light on the future of the housing market.

Understanding the Current Market Conditions

To assess the likelihood of a housing market crash, it’s essential to understand the current market conditions. Various factors contribute to the state of the housing market, including interest rates, supply and demand, economic indicators, and government policies. Let’s delve into each of these aspects to gain a comprehensive understanding.

Interest Rates and Affordability

Interest rates play a crucial role in the housing market. When rates are low, borrowing becomes more affordable, and homeownership becomes an attractive option. Conversely, rising interest rates can deter potential buyers, leading to a slowdown in the market.

In recent years, interest rates have experienced fluctuations. The Federal Reserve’s decision to increase rates in 2022 and 2023 caused concerns among homeowners and prospective buyers. However, it’s important to note that despite the rate hikes, interest rates remain historically low. This means that borrowing costs are still relatively affordable, which can help sustain the housing market and mitigate the risk of an actual crash. However, many Americans are still finding the increased interest rates and home values to be above their means.

In the graph below, you’ll see that the cost of renting vs buying in Raleigh, NC has a difference of over 50% in monthly costs. It’s not hard to see which is a more feasible option.

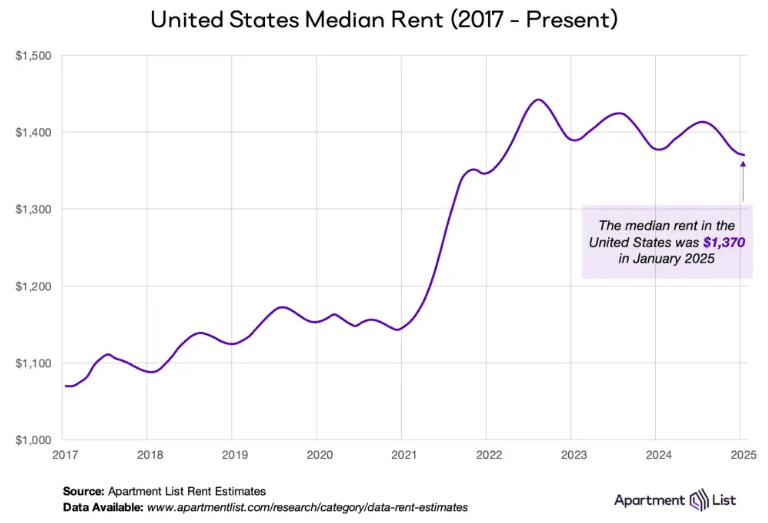

Rental Rates Declining

2023 is seeing a shift in rental rates in right direction for renters.

Supply and Demand Dynamics

The balance between supply and demand is another crucial factor in determining the stability of the housing market. When there is a shortage of housing inventory, prices tend to rise due to increased competition among buyers. Conversely, an oversupply of homes can lead to a decrease in prices.

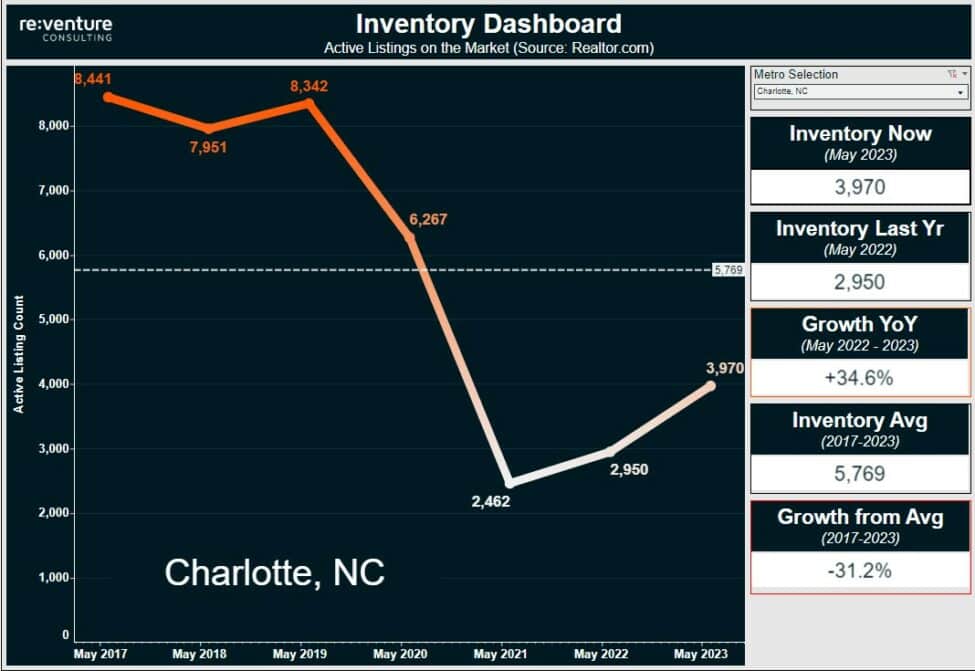

In recent years, the housing market has experienced a shortage of inventory, particularly in desirable locations. This limited supply has contributed to the increase in home prices. Unfortunately, in major metros, supply is unlikely to keep up with demand. Some indicators will note that major cities like Charlotte, NC have seen an increase in inventory, however, we’re still not even seeing the historical average number of homes on the market.

Let’s break it down for a moment. So, in Charlotte, including the urban area, we’re talking about a population of around 1.25 million people. Now, if you check Realtor.Com, you’ll see that there are currently 3807 homes up for grabs. Now, I’m no math genius, but even with a 34% increase in inventory, it’s just not enough to keep up with Charlotte’s booming growth and population.

Here’s the thing: if we want larger and more desirable cities to become “affordable” again, we’re gonna need some serious construction action. The problem is, there’s a shortage of labor and the cost of materials keeps going up, which means builders can’t churn out new homes at the pace we need. And without enough hands on deck to build these communities, it’s gonna be a tough road to make these metros truly affordable.

And to add to the fire, we’re unlikely to see homeowners put their homes on the market, even if they had to. The “golden handcuffs” phenomenon is forcing homeowners with 3-4% interest rates to hold on to their properties. There goes the supply.

Economic Indicators and Market Sentiment

The overall state of the economy and consumer sentiment also play a significant role in shaping the housing market. Economic indicators such as GDP growth, employment rates, and wage growth impact people’s ability to purchase homes. Additionally, consumer confidence and sentiment can influence buying decisions.

The subject of wage growth has garnered significant attention in recent years, and the impact of inflation has prompted discussions about potential affordability in the future. However, it is crucial to maintain a realistic perspective and acknowledge that the historically low-interest rates of 3-4% were atypical and not expected to re-emerge. Even with current rates hovering around 6-7%, we are still experiencing historically low-interest rates that offer favorable opportunities. It is unrealistic to sit around and wait for lower interest rates and cheaper homes. In that dream, hopeful homebuyers are actively hoping for a devastating market crash the likes of 2008 which would do more harm than good.

Government Policies and Regulations

Government policies and regulations can have a profound impact on the housing market. Measures such as tax incentives for homeownership, mortgage regulations, and zoning laws can influence buying and selling decisions.

Zoning laws specifically have major effects on the ability to produce more housing. Local officials dictate who, what, where, and how much can be built in a certain location. With major metros feeling the pressure from land shortages, rural neighboring communities are feeling the burden of unwillingness from their local governments.

Officials not wanting to disturb their old way of life and quiet communities are failing to approve the desperately needed building permits for large communities. These communities oftentimes provide much-needed affordable homes to the area and ultimately draw others looking for the same thing. The issue though lies in certain governments demographic and aesthetic wants and building large affordable communities often goes against their towns’ beliefs.

For a little food for thought on this, we recently saw land for sale in a rural but convenient location to Raleigh, NC – the town zoned this area so that only one home could be built per every five acres. This limitation is one small part of the problem.

Should I Sell or Rent My Home??

Keep your low interest rate and avoid capital gains!

Predictions of a Market Correction

Several experts predict a market correction in the housing market, suggesting that prices could experience a decline. These predictions are based on factors such as rising interest rates, increasing housing supply, and affordability concerns.

According to some forecasts, there could be a 10% to 15% decrease in home prices by the second or third quarter of 2023. Some major markets are currently seeing this shift with Raleigh, NC already seeing close to a 6% difference. This correction, if it occurs, would bring home prices back to a more reasonable valuation and prevent the market from becoming even more overvalued.

Long-Term Growth Potential

Despite short-term uncertainties, experts generally agree that the long-term growth potential of the housing market remains intact. Population growth, urbanization, and the aspiration for homeownership continue to drive demand for housing.

Historically, the housing market has shown resilience and the ability to recover from downturns. While market corrections are a natural part of the cycle, the long-term trend suggests continued growth in the housing market.

While not ideal for many, if you’re able to purchase property, this year will likely be the time to do so. As the market attempts to balance itself, hopeful homebuyers will see home prices continue to fall. While not guaranteed, its pretty certain that interest rates wont be lowering any time soon. However, after the market has balanced, homeowners will see their home values rise again.

Conclusion

In conclusion, while concerns (or hopes) about a housing market crash persist, the current market conditions and expert predictions indicate a more nuanced outlook. Factors such as interest rates, supply and demand dynamics, economic indicators, and government policies all contribute to the stability of the housing market.

While a market correction may occur, it is unlikely to result in a severe crash comparable to the 2008 financial crisis. The tight supply of housing, a strong jobs market, and stricter underwriting standards act as mitigating factors. Moreover, the long-term growth potential of the housing market remains intact, driven by population growth and the desire for homeownership.

As always, it’s important for homeowners and buyers to stay informed, monitor market trends, and consult with real estate professionals to make sound decisions. By understanding the complexities of the housing market and considering various factors, individuals can navigate the market with confidence and make informed choices for their financial future.