As a landlord, one of the biggest challenges you face is rental property vacancy. When your property sits unoccupied, it not only results in a loss of income but also incurs various expenses that can quickly add up. Understanding the true cost of vacancy and implementing strategies to minimize vacancy rates is crucial for maintaining a profitable rental business. In this guide, we will explore the concept of rental property vacancy, calculate vacancy rates, analyze the average vacancy rate, and provide practical tips to reduce vacancies.

What is Rental Property Vacancy?

Rental property vacancy refers to the period when a property is unoccupied and does not generate rental income. This can occur when a lease expires and you are searching for a new tenant, or when a tenant unexpectedly moves out or terminates the lease agreement. Vacancy can also arise when a property requires maintenance or repairs that render it temporarily uninhabitable.

Vacancy rates are used to measure the extent of rental property vacancy. There are three types of vacancy rates: physical vacancy rate, economic vacancy rate, and market average vacancy rate. The physical vacancy rate represents the amount of time a rental property remains vacant over a year. On the other hand, the economic vacancy rate measures the total rent lost due to vacancy as a percentage of the property’s total gross potential rent. The market average vacancy rate provides insights into how a property performs compared to the average vacancy rate for similar properties in the market.

Housing Market Crash: Debunking Myths and Analyzing the Future

The housing market has always been a topic of great interest and speculation. Homeowners, buyers, and sellers are constantly monitoring its trends, trying to predict the future and make informed decisions. One particular concern that often arises is the possibility of a housing market crash.

Calculating Vacancy Rate for Rental Properties

Calculating the vacancy rate for your rental property is essential for monitoring its performance.

To calculate the vacancy rate for single-family properties or apartments, divide the total time the unit has been vacant by the number of weeks in a year and multiply by 100. For example, if a unit was vacant for two weeks, the vacancy rate would be (2/52) * 100 = 3.84%.

In multifamily properties, the vacancy rate is determined by dividing the number of vacant units by the total number of units and multiplying by 100. For instance, if a six-unit apartment building has two vacant units, the vacancy rate would be (2/6) * 100 = 33.33%.

To calculate the economic vacancy rate, divide the total rent lost during the vacancy period by the total potential rent that could have been earned within a year. For example, if a property charges $1,300 per month in rent and has been vacant for 15 days out of a 30-day month, the economic vacancy rate would be the lost rent ($650) divided by the yearly gross potential rent ($15,600) multiplied by 100, resulting in a vacancy rate of 4.16%.

Many landlords focus on the actual dollar loss during vacancies. For example, if rent is $1,300/month and the property sits vacant for 15 days, that’s a $650 loss—calculated as (1300/30) * vacant days. Without quick action, that amount can multiply, leading to significant annual losses. Even with a 12-month lease, rental income is measured by the standard taxable year, and major revenue gaps can impact taxes, limit deductions, and affect loan eligibility.

How to Calculate Market Rental Rate for Your Investment Property

Zillow states that their Zestimate has a median error rate of 7.9% nationally. Are you comparing Apples to Apples? Determining your market rate is more than just advertising what you’d like to get.

The True Cost of Rental Property Vacancy

Rental property vacancy incurs various costs beyond the loss of rental income. It is crucial to understand the true cost of vacancy to accurately assess its impact on your rental business. Here are some of the expenses associated with vacancy:

- Loss of rental income: The primary consequence of vacancy is the loss of rental income. Each day that your property remains unoccupied, you miss out on potential earnings.

- Operating expenses: Even when a property is vacant, you still have to cover operating expenses such as utilities, property taxes, insurance, and maintenance costs. These expenses continue to accumulate, further impacting your cash flow.

- Advertising and marketing: To attract new tenants and fill vacancies, you need to invest in advertising and marketing strategies. This may involve listing your property on various platforms, paying for advertisements, and hiring property managers, all of which come with associated costs.

- Property maintenance and repairs: Vacant properties require ongoing maintenance to ensure they remain in good condition. This includes addressing any repairs or upgrades that may have been postponed while the property was occupied. These unexpected expenses can quickly add up during a vacancy period. Think of things like cleaning and lawn care that will need to be maintained.

- Potential property devaluation: Prolonged vacancy can lead to a decrease in the property’s value. A property that remains unoccupied for an extended period may be perceived as less desirable, potentially affecting its market value and future rental potential.

Understanding the true cost of vacancy emphasizes the importance of minimizing vacancies and implementing effective strategies to attract and retain tenants.

Rental Property Vacancy Calculator

Vacancy is one of the most expensive losses a landlord will incur. Our free, no-email-required, calculator gives landlords instant results on their vacancy expenses.

Strategies to Minimize Vacancy

Reducing vacancy rates is crucial for maintaining a profitable rental business. By implementing the following strategies, you can minimize vacancies and increase tenant retention:

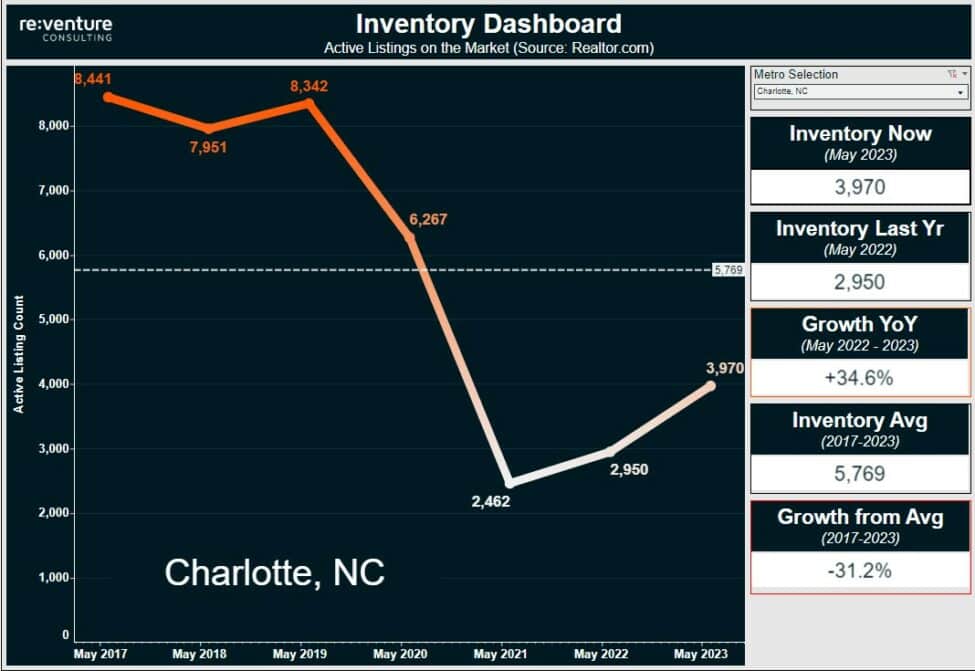

- Set competitive rental rates: Research the local rental market and price competitively. Overpricing leads to longer vacancies, especially in 2023 as renters prioritize better homes and affordability.

- Maintain good tenant relations: Building and maintaining positive relationships with your tenants can increase their satisfaction and likelihood of renewing their leases. Respond promptly to maintenance requests, address concerns, and communicate effectively with your tenants. Showing that you value their tenancy can encourage them to stay longer.

- Advertise effectively: Utilize various advertising platforms and strategies to effectively market your rental property. Take advantage of online listing websites, social media, and professional networks to reach a wide audience. Highlight the unique features and benefits of your property to attract potential tenants.

- Streamline the application process: Simplify your system for applications, background checks, and communication. Clear, responsive communication is often why residents choose—and stay with—us.

- Maintain property condition: Keep your property in top shape with regular maintenance, inspections, and upgrades to improve appeal and tenant satisfaction.

- Implement effective property management: Efficient property management plays a crucial role in minimizing vacancies. Consider hiring a professional property manager to handle day-to-day operations, tenant inquiries, and property maintenance. A dedicated property manager can focus on optimizing occupancy rates and reducing vacancy periods.

- Stay informed about market trends: Track local trends and adjust pricing, upgrades, and marketing accordingly to stay competitive.

- Continuously assess and adjust: Evaluate performance regularly. At MoveZen, we recommend lowering rent every 7–10 days if interest is low to boost visibility and interest.

By implementing these strategies and maintaining a proactive approach to managing your rental property, you can minimize vacancy rates and maximize the profitability of your investment.

Conclusion

Rental property vacancy poses significant challenges and costs for landlords. Understanding the true cost of vacancy and implementing strategies to minimize vacancies is essential for maintaining a profitable rental business. By calculating vacancy rates, analyzing average rates, and implementing effective strategies, landlords can attract and retain tenants, reduce vacancy periods, and ensure a consistent stream of rental income. Continuously monitoring market trends and tenant preferences, maintaining good tenant relations, and investing in property maintenance are key factors in reducing vacancy rates. With proactive management and strategic planning, landlords can optimize their rental business and achieve long-term success.

Remember, rental property vacancy is inevitable, but with careful planning, effective marketing, and responsive property management, you can minimize its impact and maintain a thriving rental business.