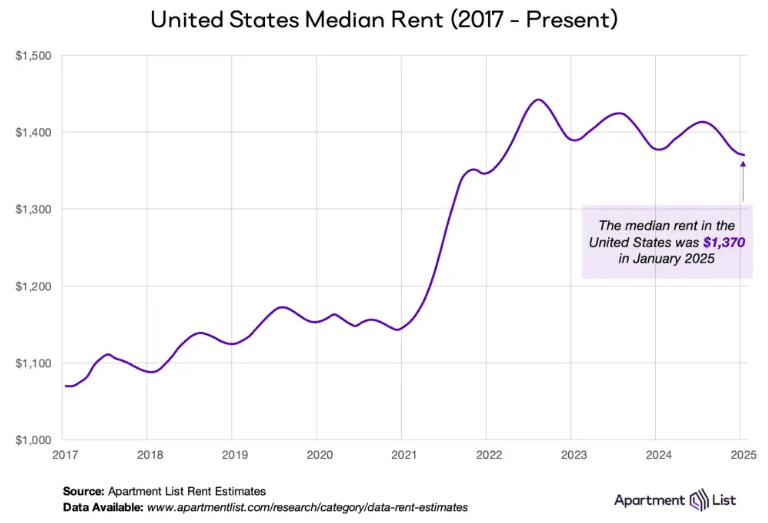

While rent growth has been continuing to follow its typical seasonal pattern, the pricing cooldown of the current off-season has outweighed the price increases of last year’s busy season, such that year-over-year rent growth is currently negative at -0.5 percent. This marks the third consecutive winter in which seasonal discounts have been notably sharper than the pre-pandemic norm. As an influx of new supply has collided with softer demand over the past two and a half years, the national median rent has gradually dipped 5 percent below its mid-2022 peak. In dollar terms, the national median rent today is $7 per month cheaper than it was one year ago and $72 per month less than in August 2022, but still remains $222 per month higher than the January 2021 level.”

For additional details and original research, visit the Apartment List National Rent Data report.

Get a Free Virtual Rental Evaluation Plus a Custom Cost Quote

Understanding National Rent Data

National Rent Data serves as a benchmark for evaluating rent growth and market dynamics across regions. Furthermore, it offers a clear picture of how rental rates are shifting across major metro areas. Consequently, this comprehensive data is more than just numbers—it is a critical tool for strategic planning that informs investment decisions and property management tactics.

Key Market Trends and Tactics

Driving Competitive Advantage with Data

Utilizing strategic insights from National Rent Data not only enhances investment strategies but also strengthens property management operations. Moreover, these insights lead to a more informed approach that balances risk with potential returns. In addition, integrating detailed rental market data into your investment planning offers a clear roadmap to success. Consequently, this data-driven strategy ensures that your property portfolio remains resilient, even in fluctuating market conditions.