If you’re a rental property owner, you’ve probably considered countless ways to boost your income and property value. But have you looked at your rental investments backyard lately? Installing a fence is a surprisingly simple upgrade that delivers outsized returns. It’s a modest investment that can increase your rental income, attract higher-quality tenants, reduce vacancies, and most likely even outperform well known investments like stocks or even another investment property at today’s rates – all while keeping the highest-quality renters happy. Let’s dive into why adding a fence is one of the smartest investments you can make in your rental property this year.

Tax Benefit Details

This is part 1 of a two part series. In part 2 we really delve into the tax implications of investing in a fence versus much more popular and glamours but rarely more lucrative alternatives. The Amazing Tax Benefits of Fencing in Your Rental Properties

As a result of rising interest rates the investment real estate landscape has changed dramatically in a very short period of time. In our field, residential rental investment we’ve witnessed astounding changes to the viability of various investment strategies, many of which few have seriously begun to discuss.

One that’s well documented is how difficult it is to find a solid cash flow investment property. It’s fascinating to us how upset a landlord can be about falling slightly below their annual cost of ownership, without considering that if someone were to buy that home today with a traditional mortgage they would earn revenue well under 70% of their costs (including mortgage) in most cases. So what feels very bad to most landlords, is actually a high-performing investment by today’s standards. It aint easy to make money these days. It’s important that investors understand how sustained inflation and higher rates will impact every facet of the economy leading to seismic shifts you can benefit from, or get clobbered by.

Measuring Rental ROI in 2025 is Completely Different from 2019

Return on investment after considering the HOA costs of amenities like gyms and tennis courts etc is one of those differences. Or even properties with pools in general. As fixed costs go up, and great service gets harder to find, high maintenance investments tend to dramatically underperform highly practical but high priority renter needs.

Enter the lowly privacy fence. The ultimate symbol of the practical American Dream. A fenced yard with family and friends cooking out on Memorial Day while the dogs run around trying to poach unattended dishes.

Also See: Why Rental Property Investors Should Avoid Costly Community Amenities in a High-Inflation Environment

Rental Property Investors, Avoid High Maintenance Amenities

We Have 20 Years of Experience Understanding What High-Quality Renters Want

We have set rental rates on thousands of rental listings over nearly two decades, and we know a lot about what renters want and pay for. High-quality renters in particular. A fence is possibly the single most sought out amenities for high-quality renters. So it stands to reason that delivering a highly sought out amenity that only economically better suited renters can and usually do justify will attract high-quality clientele. For the average rental investor nothing else is more important than consistently selecting high-quality residents.

Rental Property Fences are Very Rare

We’re a decent sized management company, and our owners almost never install fences despite the gravity of the picture we just painted. Most fenced properties come to the rental market because at some time the owner wanted that fence badly enough to invest thousands of dollars. Comparing owners to renters can certainly lead you astray, but it’s pretty clear given their prevalence relative to significant cost that almost everyone greatly values a fence.

The question is, what are they willing to pay for it and how does that measure up to other potential investments like stocks, crypto, and even other rental investments.

High ROI: Boosting Rental Income and Property Value with a Fence

When it comes to return on investment (ROI) for rental upgrades, fences pack a punch. A fence installation will pay for itself quickly through higher rents alone, while also increasing long-term property value. In fact, we estimate that the cost of a rental investment fence is typically paid directly back to you in full within about 5 years, (it’s difficult to find a better investment) but that is far from the only advantage.

Tenant Magnet: Fences Drive Rental Demand and Appeal

Installing a fence doesn’t just pad your wallet with higher rent – it also makes your rental more attractive to high quality tenants. This subtle point likely drives similar prosperity to the more obvious issue of higher rents. High-. In competitive rental markets, a fenced-in yard can set your property apart and draw in more interest from quality renters. Consider some trends in 2025:

In essence, a fence transforms your rental into a tenant magnet. It caters to renters’ desires for comfort, safety, and lifestyle. With a fenced yard, you’re offering an amenity that many renters can’t resist – and that means lower vacancy, more applications, and possibly even higher rent offers coming your way.

Note: Why the discrepancy in the percentage of renters with pets cited by our sources? The makeup of your portfolio plays a huge role. For apartments the number is the lowest in the industry, but for single-family fenced homes the number is the highest. Most of our owners are mom and pop landlords and therefore we have a lot more homes that tend to be predisposed to pet owners. We estimate that about 75% of our leads have pets, with Winston-Salem and Greensboro (Triad) being the least pet dependent markets we cover. All others are heavily pet dependent.

Inflation-Proofing Your Rental: Fences and Pricing Power

Rental rates have always been a dramatic driver of inflation and have been cited in every Federal Reserve Meeting since 2020 as a primary challenge to their fight against general inflation. Since fences contribute to rental rates, they also move higher with inflation. So they are an inflation-protected investment. If prices go up 10% your rent almost surely will eventually as well, and the return on your fence does also.

In summary, a fence doesn’t just make your rental more appealing – it makes your income more inflation-resistant. Few investments are as effective at countering inflation’s effects.

In addition to attracting the highest quality renters available, here are other top benefits to fencing a rental investment property

Anytime is a good time. Unlike most other investments, a fence isn’t timing dependent. The economy and most investments appear shaky in early 2025. A fence, as long as you will be able to pay your bills in the event of recession or job loss is not a hard decision. It pays off 365 days a year, every year regardless when it’s put into service. The investment will never move against you in any serious way (lumber and labor prices play a small role), and you don’t need an exit strategy.

Fenced Rental Investments Case Study

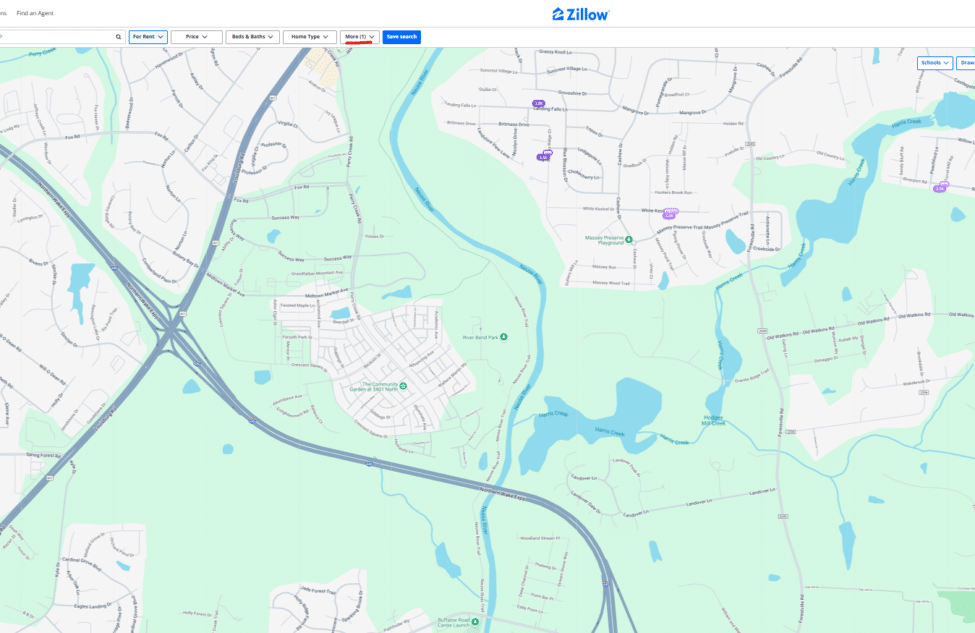

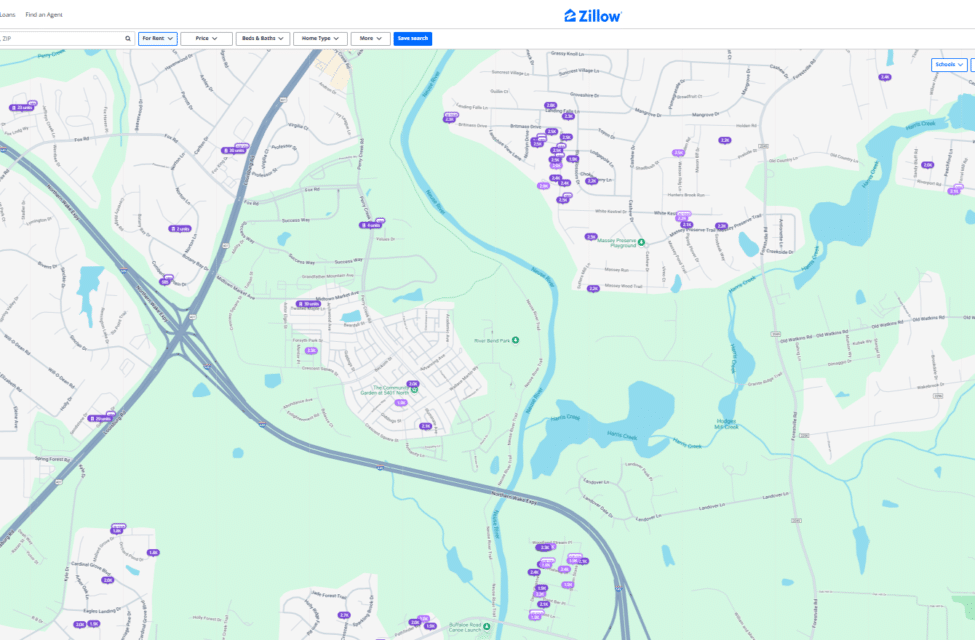

First, using Zillows keyword search we wanted to see how many homes in a given area are fenced, versus those that aren’t. You won’t need a degree in economics to see that the lack of fenced supply would dramatically increase demand. If you also allow pets, the potential pool of properties dwindles even further. Now imagine that you are a rock solid renter who wants to buy in 2-3 years, and in the meantime wants a more safe and convenient place for pets and depenents. You have a great job and the income to pay for the right place if it covers those hard to satisfy needs. Here are your options.

What a lot of investors and developers don’t realize is that pools are pretty common but not that requested, gyms, and even high-level build quality. What is almost always rare in 2025 is a wonderfully fenced yard especially if also allowing pets.

Always Respect Supply and Demand When Investing in Real Estate

Now, consider the map below. For a small investment many of these owners could move from a model of competing with 95% of rentals, to one competing with 5% and that also attracts the highest quality residents in the industry.

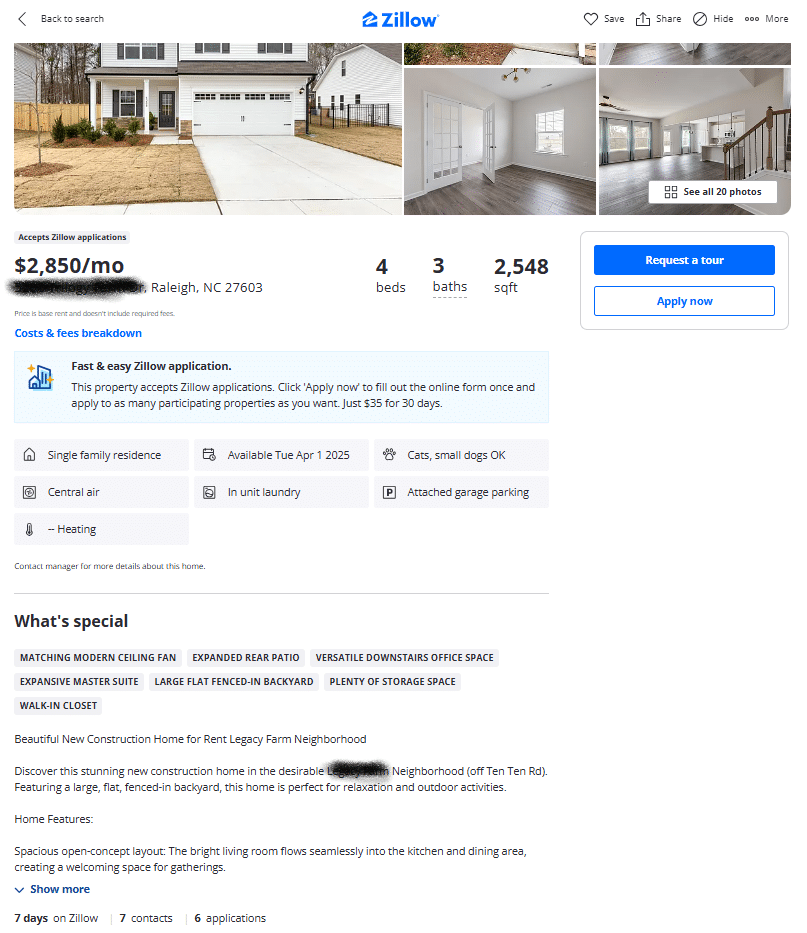

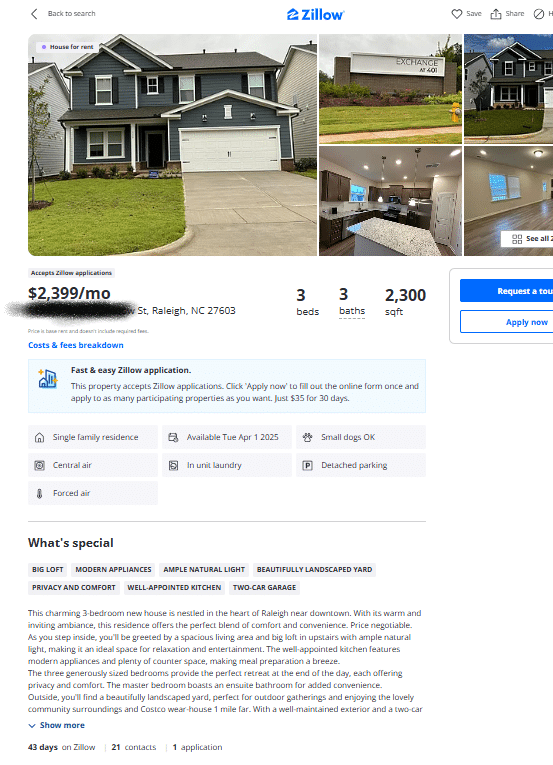

Comparing several homes that are both fenced and unfenced usually shows clear advantages for the fenced home.

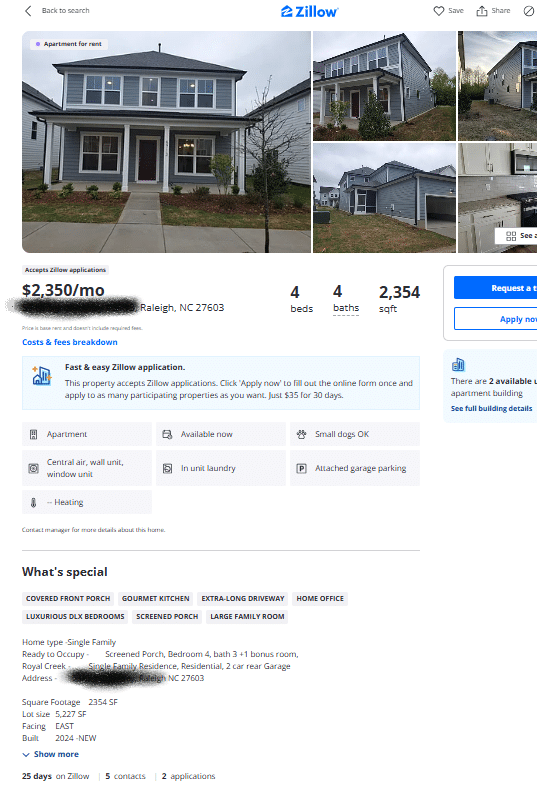

The home below has a nice large fenced yard, yet surprisingly only one photo of it. Note at the bottom of the image how it is getting decent interest from renter leads while being priced well over $1 per square foot. That’s a very common price point in the suburbs around all NC and SC cities. So a 2000 square foot house often rents for $2000 a month. This home is likely to rent quickly at a rate closer to $1.11. That might not sound like a lot but that’s $3600 a year in this case, or 11% which is almost exactly inline with our estimates that they add 5-15% to rental rates. In peak summer season it might even be as high as 20% especially when pet friendly. That’s a lot of money and over time has exponential effects on your cash flow statement.

Broad and Anecdotal Evidence

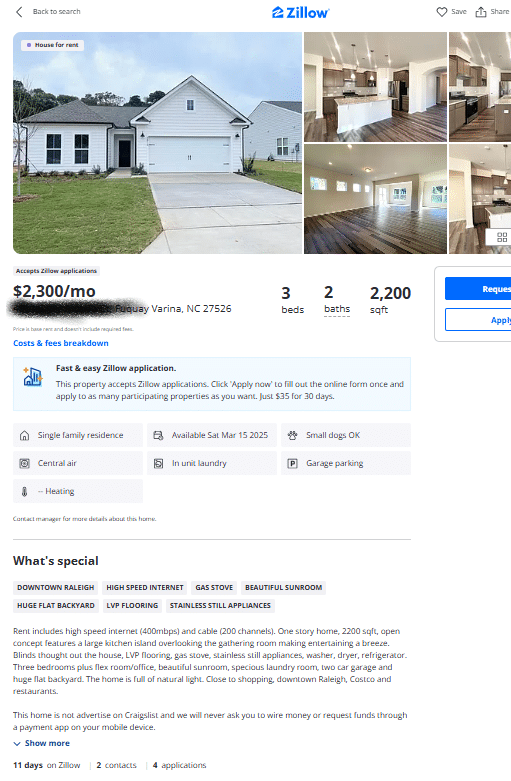

To be fair the above home is presented better than these competitors, but not to the extent that it would be receiving dramatically higher general interest. Consider how the fenced home is doing well priced well over $1 per square foot, whereas these homes are struggling a lot priced around that common price to sqft ratio.

This home though is likely to rent any day, which will proably be 30-45 days sooner than these competitors. It will probably be a AAA quality renter who will value the product they received, and struggle to replace it should they start to consider a move.

Conclusion: Small Upgrade, Big Payoff

The money you invest today will pay off for almost two decades before you seriously need to consider a replacement. Even then it would still likely add 2% to the sales price if you went that route, and 5-10% to the rental rate as well. Over 20 years or more a nice fence will consistently contribute 5-20% more revenue for your rental property.

Installing a fence on your rental property may not have the glamour of a brand-new kitchen or the thrill of a stock tip, but as we’ve seen, it’s one of the savviest investments you can make in 2025. This single improvement tangibly increases your rental income, enhances your property’s value, appeals to the vast majority of renters, and fortifies your investment against inflation and vacancies. It does all this without breaking the bank or requiring constant upkeep. The tone of the market is clear: renters crave the privacy, security, and freedom a fenced yard provides – and they’re willing to pay for it, and stay for it.

In the world of real estate investing, success often comes from smart, practical moves that yield steady benefits. A fence might seem simple, but it hits all the right notes: higher ROI, tenant satisfaction, and long-term asset growth.

Sources:

kwappraisalgroup.comkwappraisalgroup.com

Zillow via Multifamily Dive – 59% of renters had pets in 2023, up from 46% in 2019multifamilydive.com

Apartments.com survey – Nearly 90% of renters have a pet; pet-friendly policies are crucial in housing choicesamerican-apartment-owners-association.org

LJ Hooker (NZ) – Pet-friendly rentals fetch higher rent, reduce vacancies, and increase tenant loyaltyljhooker.co.nzljhooker.co.nz

Landlordology (via Dumpsters.com) – Expert: 75% of her renters were pet owners; adding a fence was “always worth it”

Azibo Rent Report – Rents jumped ~18% in 2021 and 12% in 2022, far above normal ~3% yearly averageazibo.com

Vaster Real Estate Blog – Real estate and rental income serve as an effective inflation hedge; landlords can raise rents as costs riseblog.vaster.com

LJ Hooker – Allowing pets (with proper amenities) leads to longer tenancies and renters who care for the homeljhooker.co.nz