We do thousands of rental market estimates a year, and with that kind of repetition, you start to notice issues that rarely get discussed. One major issue we’ve run into lately is the mindset and strategy changes that need to be made in response to a long-term high-inflation investment environment. Costly community amenities just don’t deliver winning returns on inevestment anymore.

Labor costs are very high, material costs are very high, and deportations combined with tariffs appear poised to drive both dramatically higher. So it stands to reason that you want to avoid high-maintenance or upkeep strategies as much as possible.

What is a high-maintenance strategy?

An HOA-managed community gym is pretty high-maintenance. Have you ever owned a treadmill? How long before it broke with standard use? Have you ever owned a pool? How many hours each month were spent just keeping it useable? How about keeping it safe and not an eyesore when not usable?

These are major issues to consider in 2025 that have profound effects on the returns you might expect from your rental investment.

Investment Type Matters a lot These Days

Condos in particular are often stuffed with extremely high maintenance systems. They also have to compete with endless new direct competition apartment construction on every corner. So these issues apply to condo investments more than most. They often have elevators, game rooms, and many other amenities that require constant care. The competition in multi-family apartment development has made these amenities necessities for investors looking to max out community value.

We outlined a decade ago that condos would likely underperform the broader market. That’s due to the non-stop flow of new, feature loaded apartment competition. Inflation has only exacerbated the issue significantly in recent years. Condos are not particularly good rental investments in general, and probably aren’t great appreciation bets either. Especially when compared to townhomes and houses.

However, the issue of costly amenities also affects single-family townhomes and houses as well.

Flashy Amenities Rarely Lead to Flashy Rental Returns

In our article proclaiming the amazing benefits of fenced rental properties (read more), we discussed how durable that investment is. Often providing financial benefits for nearly 30 years while also delivering some of the greatest enhanced rental returns of any decision a landlord can make (especially when combined with a reasonable pet policy).

We outlined that the direct payback period for a rental property fence investment is usually under 5 years which is more often than not much better than one could expect from buying another rental property, stocks, or almost all mainstream investments in today’s high-inflation and uncertain world. They also require almost no maintenance, reduce vacancy by a significant amount almost without fail, and are simple, low-risk, and easy to install.

Hard to Beat Investment Performance Starts with Practicality

Due to compounding and indirect hard-to-quantify benefits such as less vacancy and higher-quality residents, we estimate that over 5 years a landlord should expect at least 30% higher returns than they would otherwise have, especially if combined with being pet friendly. If you run the math on this it’s something along these lines.

$2,000mth – 5% for vacancy = $1,900 — Multiply by 12 months and you have gross rent of about $22,800. Multiply that by 5 years which is about the average time a landlord stays with our company, and the total is $114,000. If you are able to increase your returns by 30% that’s $34,200. So in 5 years you would more than pay for the cost of most fences (the benefits do decline with exceptionally large yards) but would have 15 to 20 years of low-maintenance life left in that investment. This is also on the low end of the range with few fenced homes not at least seeing these results.

Let’s compare this approach to a nearly identical home that swaps a fenced yard for fancy pools and gyms.

Practical Offer Versus Personal Preference

Maintaining a pool is expensive. Often despite paying hundreds of dollars a month community pools still end up closed for weeks due to bacteria. They require enormous amounts of freshwater (not ideal for the environment), and many legally required safety features like hard-to-maintain bathrooms, live phone lines to call for help, and gated access. This applies to the simplest of pool setups. Add in a clubhouse (often with kitchen and appliances that are themselves expensive to maintain), kiddie pools, umbrellas, chairs, inflation-vulnerable insurance, and many more costs and it’s hard to understand how this cost was justified as much as it was even in the low-cost heady days of 2010-2020.

Even Worse ROI Than a Pool

Maintaining a community gym is also extremely expensive. “Dumbbells” are shockingly expensive, and they are the only somewhat cheap item you will find in a gym. Treadmills, ellipticals, and similar equipment cost thousands to buy individually and require significant never-ending maintenance.

According to athleticbusiness.com the average lifespan for a commercial treadmill is about 4 to 7 years (read more). However, during that time you have to deal with downtime, perform major maintenance, and replace multiple parts in most cases. In the end, they have almost zero salvage value. That’s one device when most gyms have several.

“In a commercial facility such as a health club or rec center, a typical treadmill will last between four and seven years, depending on the model and assuming regular maintenance and upkeep.”

Costly Doesn’t Guarantee Bad Results

We know gyms are surprisingly common in the rental market which reduces scarcity (decent supply depresses demand). We also know they are incredibly expensive to set up, maintain, and offer no salvage value. But what kind of income potential do they have?

We’re focusing more on the average rental market in America. In extremely dense major cities where these amenities are often standard, the numbers might not be as bad but are most likely still pretty bad especially if your condo HOA is providing these amenities to compete with brand-new ultra-modern high-rise apartment complexes.

Rental Rate Returns That Would Surprise Most

In our experience managing homes in large cities and small towns spread all across NC and SC, the rental increases for these costly amenities are negligible and average around 8% higher rents. Homesteadstructures.com (ironically in an attempt to sell pools) cites a Zillow study that found pools increase rents by about 4.5% or $70 a month on average. That is less than one hour of pool company labor charges in almost every market. (Read More)

There doesn’t even appear to be data on the increased rent you might expect from a community gym, and that’s likely because it’s barely measurable. In our experience, it’s 2-4% or $35 a month for the average rental in America. That’s about 1/5th of specialized hourly treadmill maintenance labor costs.

Even with Loaded Amenities, Returns are Unimpressive

If you combine both you would be lucky to see a 7% increase on your rental rate. However unlike a fence, they do not clearly attract higher than average quality renters, they do not contribute to longer than average lease terms, and do not reduce vacancy in any meaningful way. They drive up insurance costs whereas fences drive them down. They are a massive safety hazard whereas fences enhance safety. The cost of maintenance relentlessly rise at least in line with inflation (often more), whereas fences are mostly a one-time investment at today’s prices. Getting the picture yet?

What Are Common Costs Associated with Popular Community Amenities?

A higher-end community with a pool, clubhouse, and gym would likely require $500 a month or more in added HOA dues. Yet we already established that you would be lucky to earn $100 a month more in rent. Who makes up the $400 per month difference since your tenant doesn’t? You do, the investor.

We noted that fences directly contribute close to 15% higher rents, and indirectly contribute to your bottom line in a multitude of ways as well. Even though the cost of installation can easily cost less than the added single-year dues from those more costly amenities.

Bronze Handcuffs

These numbers are so stark it should make every landlord who owns one of these properties take a long hard look at whether they could do better. Unfortunately, most are golden handcuffed, or in these cases, you might say bronze handcuffed to these properties by 3% mortgage rates.

Case Study:

The idea for this article came about as we compared homes in an area in SE North Carolina known for significant amounts of new construction in single-family house communities that are often loaded with amenities. It’s a relatively small town, Leland NC, and provides a clear view of a local rental market that isn’t very diverse which makes comparisons easier.

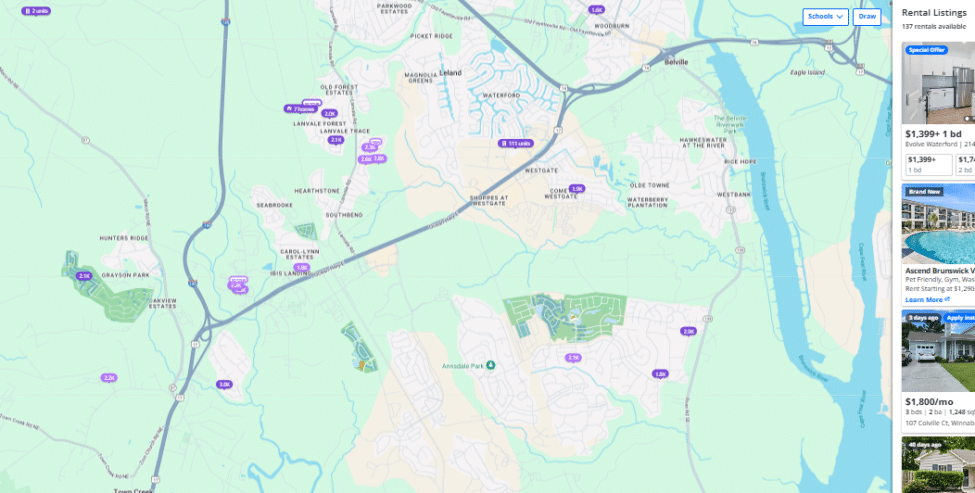

First, we begin by comparing a map view on Zillow Rental Manager that covers a wide area in that market. We used their keyword search option to search for properties with a fence, and that produced 137 results which is much higher than most major cities where rental home fences these days are extremely rare. A phenomenon we discussed at length in our article “Why a Rental Property Fence Could be the Best Overall Investment You Make in 2025. Rental Property Fence ROI Analysis and Case Study“

3 Pool Properties for Every Fenced Property For Rent is About Standard

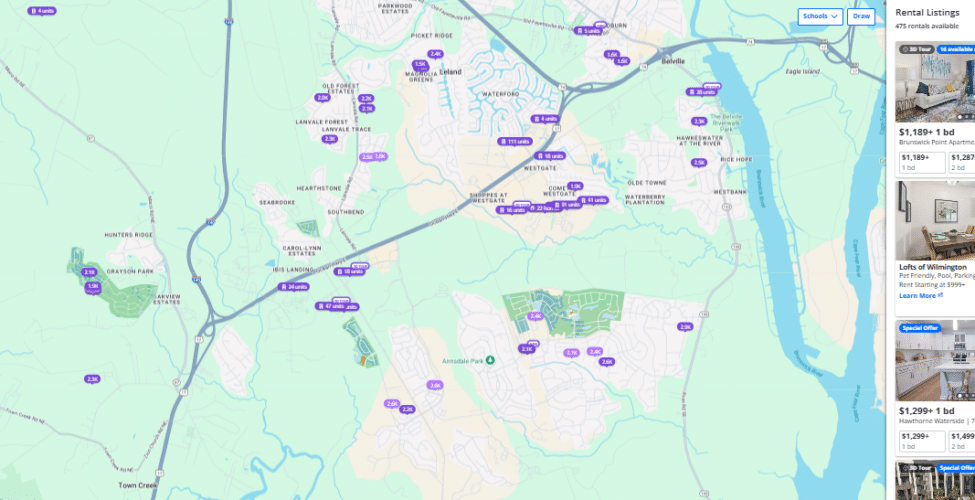

We then switched to search for pool and found 475 results over the same area. That’s more than 3 to 1. So right on the surface, we can clearly see that fenced properties are dramatically more scarce than properties with pools. Despite having a much higher-than-average fenced rental pool.

At Least 2 Gym Properties for Every Fenced Property For Rent

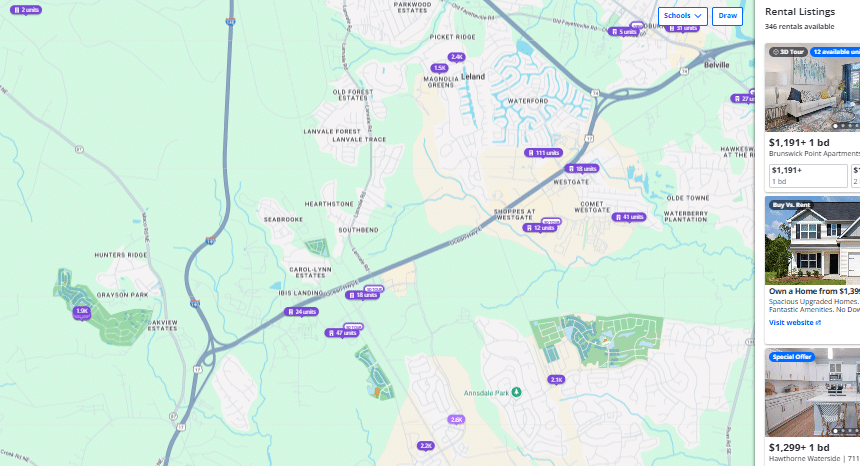

A search for the keyword gym returned 347 results. This is more likely to refer to gyms near the community rather than part of it, but you can assume it’s at least 2 to 1.

All 3 of these searches are subject to problems, but given the relatively large sample size, they would be smoothed out. These problems include the shocking degree to which landlords and property management companies fail to include crucial keywords and photos when pools and fences are part of the offering (if your manager didn’t heavily highlight your fence then you should fire them now). This is a rental management cardinal sin in our view since these features are proven to increase rental investment performance significantly. It’s like trying to sell a watch without disclosing the brand, it makes absolutely no sense. It is however common and results in pools and gyms being listed less than fences since it’s not always obvious that a community has them, and owners often never mention it to their rental agents. Fences are a bit harder to miss. That means these raw numbers are probably even more stark than they first appear.

Let’s look at some specific examples.

Rental Houses with Pools

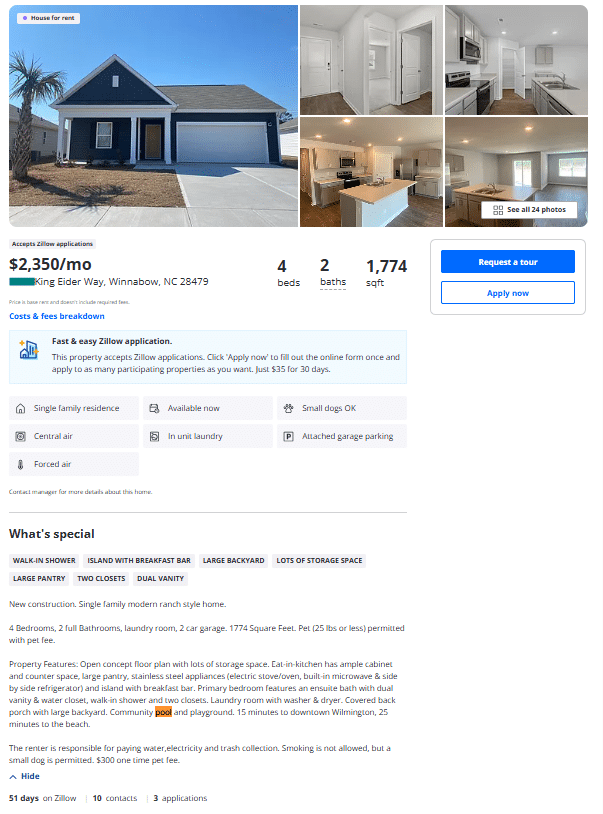

King Elder Way. Listed at $2,350, 1,774 sqft, and has been listed for nearly 2 months with 10 contacts (not good and rarely enough to result in a high-quality lease). The home has a community pool and no fence. It appears highly unlikely to rent at this price despite being almost brand new (usually adds 10% to the rate).

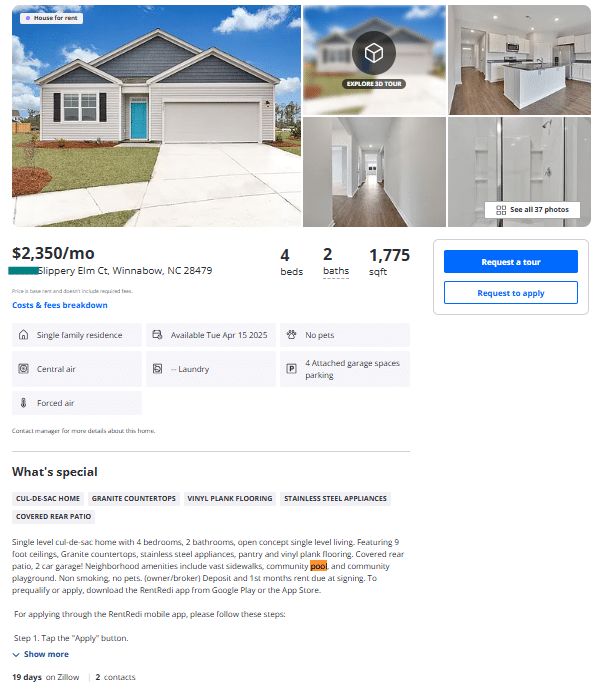

Slippery Elm Ct. Listed at $2,350, 1775 sqft. Listed for 19 days with 2 total contacts. That’s essentially non-existent and there’s almost no chance this home will rent here. Has a community pool and presumably HOA does well over $300 a month.

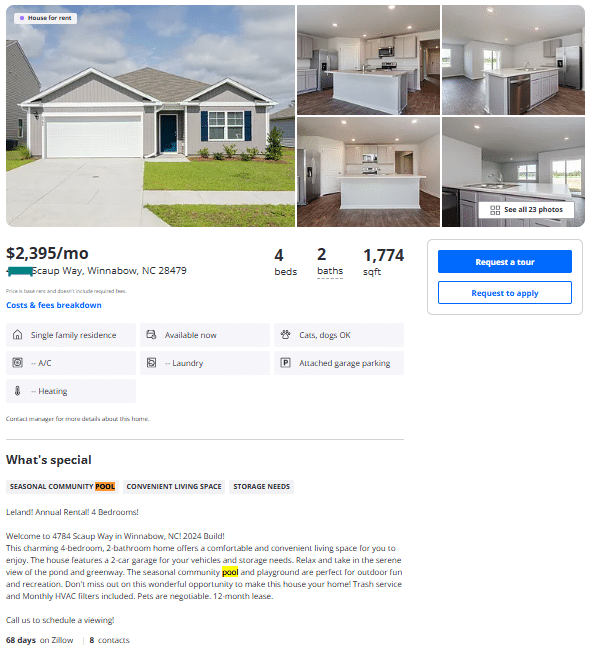

Scaup Way. Listed at $2,395, 1774 sqft and has had 8 contacts in over 2 months. Another lost cause. Has a community pool and presumably HOA does well over $300 a month.

So Scarce We Struggled to Find Comparisons

Rental Houses with Fences: Unfortunately due to the fact that fenced properties are extremely scarce, even over a 5-mile radius we struggled to find great comparison homes.

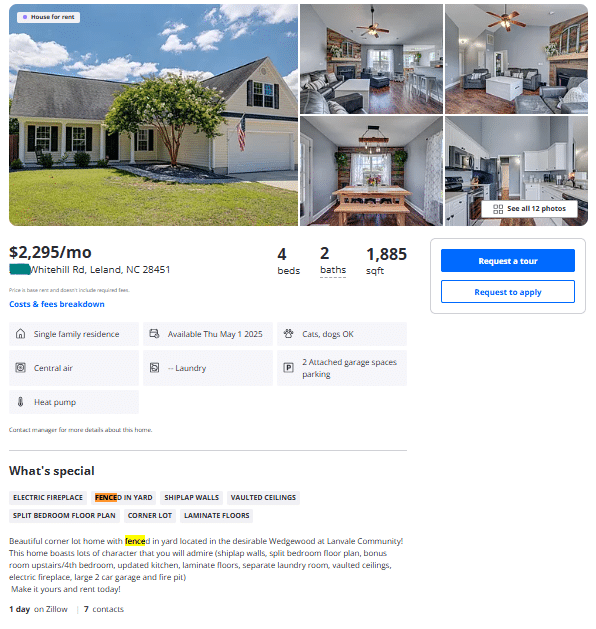

Whitehill Rd. Listed at $2,295, 1,885 sqft. This home was built in 2007 making it almost 20 years older than the homes above. Has 7 contacts on day 1 and will likely be rented in less than 2 weeks.

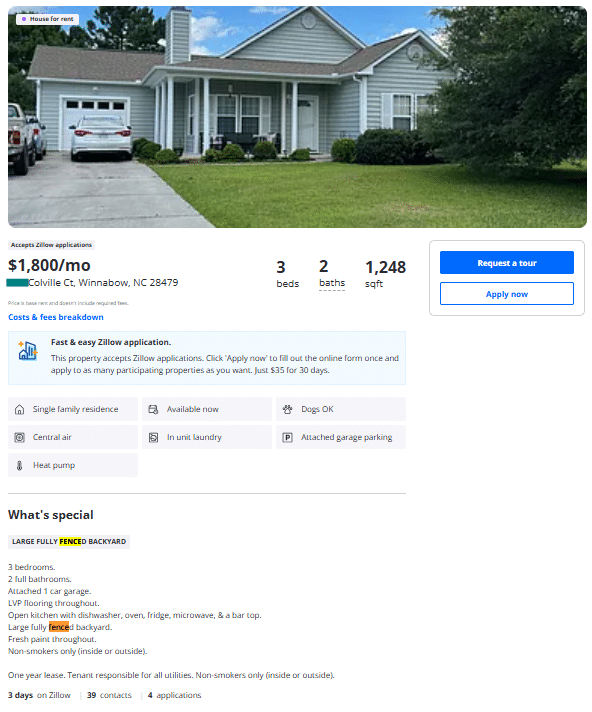

Colville Ct. Listed at $1,800, 1,284 sqft, and despite being by far the highest price per sqft of all the homes shown, and an atrocious listing presentation so far has 39 contacts after 3 days on market.

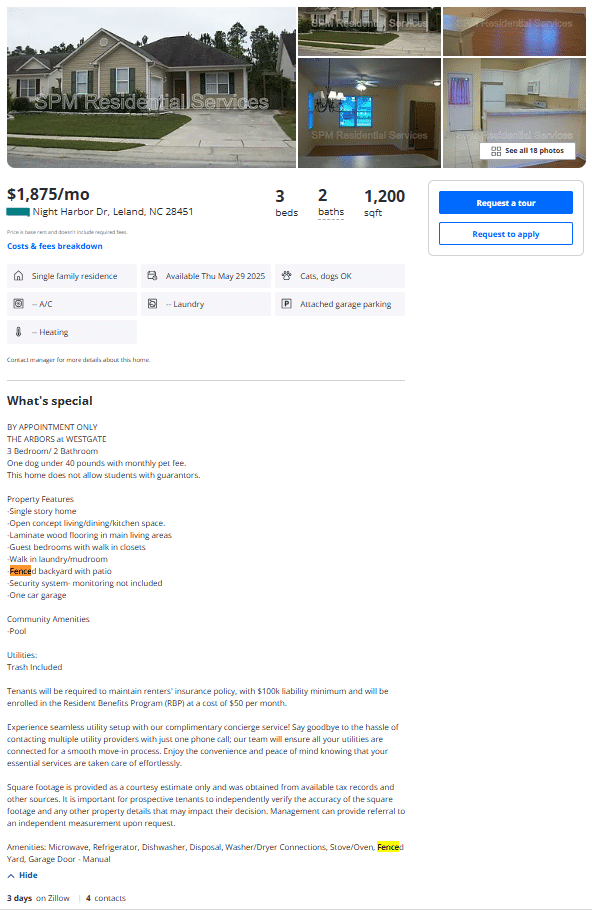

Night Harbor Dr. Listed at $1,875, 1,200 sqft, and also horribly presented while priced far higher than all the brand new homes with pools has more contacts (4) than days listed (3).

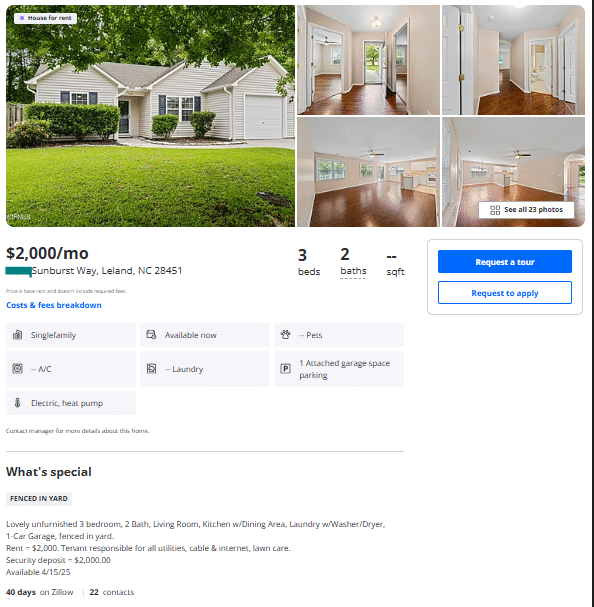

Sunburst Way. Listed at $2,000, estimated 1300 sqft and decently presented despite a dated paint scheme, and has 22 contacts in 40 days.

This home and community are 20 years old. In fact, most of the fenced examples we provided are nearly 20 years older than the unfenced examples. Yet in most cases despite questionable listing presentations they are earning double and triple the traffic that the new homes with pools and $400+ added HOA dues homes are getting.

Eye-Opening Numbers Even for a Seasoned Rental Investor

That’s an astounding comparison and is likely far more significant than even we outlined to begin this article, in an area with a much higher-than-average number of fenced rental houses.

Long story short, friends don’t let friends invest in high-cost HOAs or amenities. Fence in your practically appealing rental instead.

In our next article, we’ll dive into the financial consequences of investing condos versus houses.