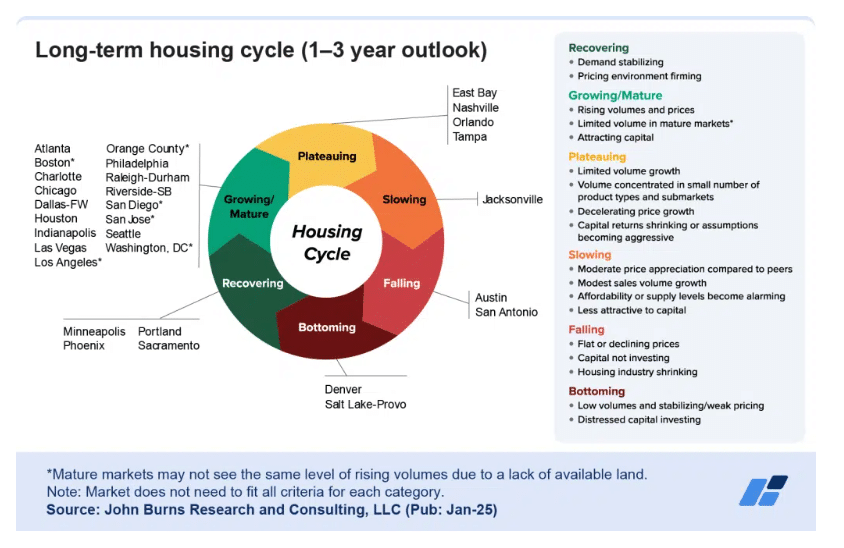

The real estate cycle is evolving rapidly in 2025. Local trends mirror national shifts. Our community is impacted by rising demand and a tight housing supply. Investors and residents alike are watching this cycle closely. To read more about the cycle, read this article.

Market Trends

Current market conditions show clear signs of change. Inventory remains scarce, and new construction is progressing slowly. Home prices are climbing as buyers face intense competition. Key factors include:

Recent statistics indicate that home selling conditions are not as favorable as they were a year ago. An increase in both new and resale listings, combined with mortgage rates now exceeding 7%, has softened seller advantages. This trend is even more evident in Sunbelt markets, particularly in Florida and Texas. Regional differences are significant, emphasizing the need to monitor local trends closely.

Experts believe these conditions signal a turning point in the housing market cycle. The evolving landscape challenges both buyers and sellers, forcing them to adjust their strategies as the market continues to shift.

Get a Free Virtual Rental Evaluation Plus a Custom Cost Quote

Investor Tactics

Investors must adapt quickly in this evolving landscape. Tactics include:

Understanding the housing market cycle is essential for making informed decisions. This cycle guides investment strategies and helps predict market shifts, offering valuable insights for navigating regional disparities.

Local Perspective

In our community, the impact of these trends is felt daily. Homeowners experience pressure as property values rise and available homes dwindle. Local residents and business owners see both challenges and opportunities. Smart, data-driven investment tactics can ease these pressures and foster long-term stability.

Ready to Get Your Rental on the MoveZen System?

Our ultimate goal is to maximize your bottom line income while minimizing headaches. This starts with our new owner onboard process

Thinking of Switching Property Management Companies?

Don’t let the unpleasant task of working with your current manager to close out your account hold you back, we’ll do it all. Just notify them once in writing, and we’ll do the rest

Conclusion

The 2025 real estate cycle is a crucial barometer for our community. With limited supply, rising costs, and significant regional differences, local investors must adopt agile strategies to navigate this evolving market. By leveraging these insights, our community can drive smart investments and achieve lasting stability.