How Can Teamwork Deliver $100K+ to Struggling Rental Investors? Our December to Remember

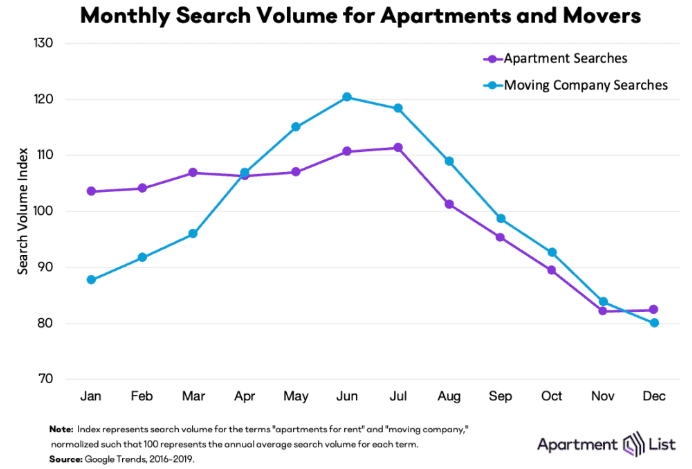

2023 was a slow year for the rental market. There were brief periods of strong activity and long gaps of low traffic. You had only a few small windows to fill a home before a wave passed if you did not drop the price. We see a minor version of this pattern every year, as shown in a seasonal chart from Apartmentlist.com.

Note this chart shows search intent, so website traffic in January and February is typically planning for a spring move. They are the slowest months for our company.

This year, the slow periods were more pronounced. The usual fall bounce arrived later than in our 20-year history. By Thanksgiving, many homes had been on the market longer than ever before. This is not a strategy we would choose. We view vacant homes as risky and costly.

Get a Free Virtual Rental Evaluation Plus a Custom Cost Quote

Misconceptions & Trends in Rental Pricing

Common Misconceptions about Tenant Quality

Owners found it hard to lower top-line rental rates. Many choose to absorb a $100 per day vacancy cost instead of reducing rent by $100 a month. They are betting on the “bird in the bush” rather than the one in hand. We have heard many mistaken assumptions such as:

– A lower rent attracts lower quality tenants. In fact, great tenants have good finances and make smart money decisions. High credit quality earns low interest rates, while risky borrowers pay a premium. Competitive pricing is the best way to secure quality tenants. Data shows high-quality residents are more profitable over time.

The Pitfalls of Waiting for a Better Market

Some owners believe it is cheaper to let a home sit empty than to lower the rent. This is false. A vacant home cuts into long-term net income. Tying pride to top-line results is risky. For example, if a home sits empty for one-third of a year, even a high rental rate loses value. Renting for one month at $300 less may boost net income significantly. High-quality tenants find value and tend to stay. They pay reliably and care for your asset. In an inflationary market, vacancies lead to disaster. Maintenance problems occur more in empty homes. Underused ACs and water heaters are more likely to fail, especially in extreme weather. We perform most maintenance at move-in and very little afterward.

– Some owners say, “I’ll just wait for a better market.” This statement often hides pride. Many ignore the cost of vacancy or the cost of a lower-quality tenant. Like low-quality borrowers paying high interest, these owners risk high costs. The market rarely recovers in time. They end up with 2–3 months of vacancy, wasting around $6K per home, and then they reduce rent by over 10%. This is a lose-lose outcome that hurts long-term investment performance.

Strategic Leasing in a Slow Market

Lease Strategies & Tenant Quality

Professional managers sometimes accept vacancy costs. They know when it makes sense. However, this knowledge is rare outside the trenches.

In late February 2024, we entered a period when “waiting for a better market” seemed possible. Things were slow. We feared the market would not rebound until late April or even mid-May. This strategy might cause 2.5 months of vacancy. Prices might only rise slightly.

Financial Implications of Vacancy

We often sign 14- to 16-month leases to reduce seasonal challenges. Some owners worry they will get a low winter rate for longer. However, a lower rate can lead to a higher quality tenant. A high-quality resident reduces many problems. They lower repair costs, vacancy expenses, eviction costs, and other issues. High-quality tenants move more often but incur less turnover cost. In contrast, low credit quality residents stay longer because the application process is expensive. This results in larger, more stressful turnovers.

Post-Thanksgiving Market Conditions

After Thanksgiving, we faced 30 vacant homes and little traffic. We had warned owners for a month that traffic would soon pick up. We advised them to wait on reductions until the market showed signs of life. Our common strategy is to delay price cuts until a market upsurge occurs. A small, well-timed reduction can fill a home quickly.

The December Strategy: Swift Action

Initial Assessment & Strategy Formation

When we returned, the market still showed no signs of life. Our company went into red alert mode. The leadership team met and reviewed the numbers. They realized that without quick action, owners would lose over $45,000 in December alone. January and February are the slowest months. We estimated almost $120,000 in lost rent due to vacancy. Winter is a terrible time for vacant homes.

Implementation Tactics

We enacted a clear strategy. First, we sent operations teams to each vacant home. They checked if repair or update issues would prevent renting at the current price. Next, we worked quickly with owners to get quotes and approvals for repairs. Our new operations division completed these jobs swiftly and cost-effectively. Then, we sent our best photographer to re-shoot the listings. We updated the photos, listing positions, descriptions, and area images. We also implemented small price reductions that had been held back. Finally, we ran significant social ads for each property. Each ad not only promoted one home but also drove traffic to our site overall.

We used almost 20% of our annual marketing budget during the three busy weeks between Thanksgiving and Christmas.

Building Confidence Through Teamwork

Our urgency became clear to the owners. Our messaging began to catch traction. Owners grew more confident in our advice. They shared our concerns about winter vacancy. We then secured the necessary price reductions. This outcome felt like magic for a property management nerd.

Our operations division had spent months building their team. They then shifted to support our account managers fully. This ensured account managers stayed active at their stations. They managed heavy traffic and coordinated with field staff who needed dispatch and admin support.

Overcoming Skepticism & Embracing Collaboration

Initially, account managers were skeptical of the new operations team. They feared change might disadvantage them. The operations team doubled down and offered hard-to-refuse support. This support helped reverse the “do it all myself” mindset. Soon, account managers leaned heavily on the operations team. They could not handle the increased load alone. Their needs aligned with those of our customers, especially the owners with vacant homes.

The Power of Teamwork

For our company, teamwork has always been a core value. We are built like a sports team and collaborate deeply. This moment showed the benefits of teamwork. It united a division focused on customer and financial results with one that executes tough tasks quickly. This collaboration signals amazing future outcomes.

We watched the magic of collaboration unfold. The process delivered results as intended.

Ready to Get Your Rental on the MoveZen System?

Our ultimate goal is to maximize your bottom line income while minimizing headaches. This starts with our new owner onboard process

Thinking of Switching Property Management Companies?

Don’t let the unpleasant task of working with your current manager to close out your account hold you back, we’ll do it all. Just notify them once in writing, and we’ll do the rest

Rental Success & Financial Impact

By Christmas, we had rented nearly every struggling vacant home. Most were leased to high-quality residents who timed their moves to find value. As of late February 2024, we estimate an additional $100,000 to $150,000 in rent income. This income offset vacancy costs and boosted long-term investment performance.

That’s the power of great management.