Updated Seasonal Property Management Website Traffic and Search Patterns October 2025

The Back-to-School Lull is in Full Swing for 2025

Earlier this year, we posted our website traffic statistics from the previous summer to help us demonstrate for owners why it is always so important to have rentals filled before schools are in full swing, or the back-to-school lull, as we call it. We predicted a similar pattern, as it’s an annual occurrence.

This summer started off slow, then somehow slowed even further. That was a major surprise. Furthermore, because a lot of rental rate increases for the year are made in late summer, we moved into fall having had declining rents in our markets since early 2023, with a complete dud of a summer crescendo. That summer burst is needed by rental investors to set a new “base” in rental rates to drive higher the following year.

Make Your Home Stand Out With This Guide To Getting Perfect Rental Presentation Pictures

The Summer Rental Market Was a Dud

This came together to mean shockingly low rental prices in some situations, in particular. The issue is widespread across our NC and SC markets, though the Greenville-Spartanburg, SC metro rental market is faring better than our NC cities and towns.

So far this year, we’ve formally estimated rental rates for around 900 rentals across NC and Upstate SC. In the course of that work, we began to realize that rents today were often 15% below what renters were paying today in their old rolled-over leases. We predicted at the start of the year that we’d have a lot of moves in 2025 as a result of long-term rent declines, but we thought it would be in a recovering market. We experienced the typical seasonal variations, and rents are mostly flat, but after a decade of relentless growth followed by 2 tough years, a flat summer is surprisingly bad.

An Exclusive Party

As the summer wore on and we saw that some rates were actually falling, we began to suspect that the fall market would be better than usual as renters noticed rates that were too good to ignore. That’s essentially what we’ve seen. This is not a rising tide that floats all boats, though. Most of these people are the smarter “value hunters”; they have good credit and know that entitles them, they expect a deal if they are going to take on the moving hassle, and they are on a mission to find the features they have been missing for many years. This leaves marginal properties and strategies out in the cold, often vacant for months, despite deep discounts. The more appealing rental strategies are tougher than ever, but they work without major reductions or resident-quality problems.

Would You Rather Run a Motel 6, or a Marriott?

We discussed this issue when the world first began coming to terms with a high-inflation environment that we felt was likely to last many years and upend almost 25 years of mostly deflationary experiences. In an effort to convince our owners to continue to invest in preserving and elevating their properties despite exploding expenses, we outlined the trap this thinking was by asking would you rather run a Motel 6 or a Marriott?

Marriott investors don’t want to invest 100+% more into annual maintenance and customer service for the fun of it; it’s crucial to maintain their premium model and a happy, high-quality customer base. The discount model up and down the economy has been a clear loser in the aftermath of COVID. In our view of the modern rental market, landlords will provide quality, or they will not find quality customers. In our business, that is bad for everyone and usually leads to bankruptcy or many years of poor performance and stress.

See: A Look Back and Ahead with MoveZen Property Management 2024

Managing Rentals is Much Harder than Many Realized, Though that’s Starting to Change

In short, being a landlord is tougher and riskier than ever. Even after 20 years in business, we often struggle to understand much of what we are seeing these days. The tools required to thrive in this business are not cheap and are not for novices, often requiring advanced knowledge to utilize well, and a phenomenal property manager is now more valuable than ever. Not to mention the increased time required to ensure great, consistent rental results.

Presentations have mattered in 2025. A great price can still overcome a bad presentation, but in situations with several similar-priced competitors, the ones with the best presentations (assuming they combine that with fast, productive follow-up) are the ones that rent in a reasonable time. The others are often vacant for 3+ months, which wipes out 24+% of your potential revenue. Not your profit. Revenue makes up 80% of the pie that determines your profit, so it has a magnified effect on bottom-line profit

You can see the financially detrimental effects of failing to understand how crucial it is to maximize revenue in rental investing by using this vacancy calculator tool.

The Cold Statistics

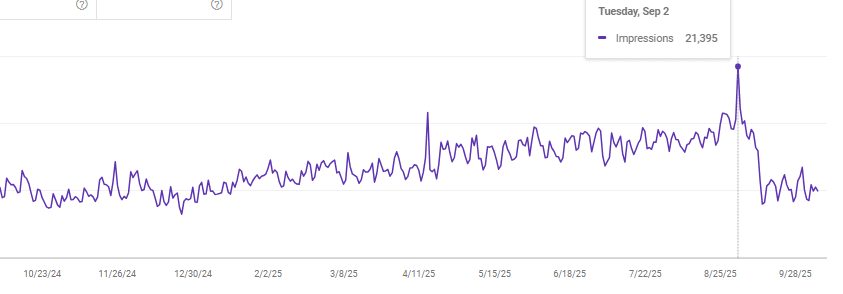

The chart above illustrates the Google search “impressions” for our website in 2025. Since about 80% of our traffic comes from renters looking for a home now, it’s an exceptional indicator of the strength of our local markets. We also see a noticeable change in actual contracts signed as these trends shift throughout the year.

As you can see, we declined sharply right after Labor Day in early September. In past years, that decline never occurred later than mid-August, so the market stayed relatively strong for just under a month longer than years past, in large part due to the amazing rental rates potential movers are seeing.

So it was a concern to see such a marked decline despite enticing low rental rates. We are now into the second week of October, and rents are low, the market is very slow, and some homes are as stagnant as we’ve ever seen, but the adage holds true that the most desirable homes are consistently renting in a reasonable amount of time, without major discounts.

Every Year is Different These Days

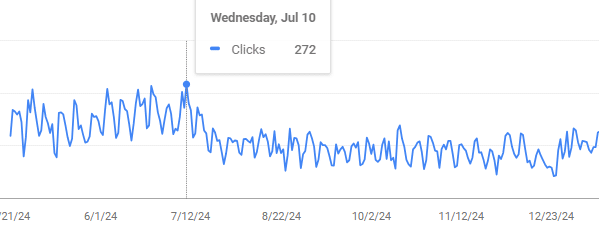

Another interesting but likely unimportant issue with our website traffic is that, as we outline below, our traffic also fell off dramatically in 2024, but it occurred right at mid-July. While we definitely slowed on contracts signed, in 2024, our “website impressions” held steady, while our clicks declined dramatically. Possibly due to the rise of AI bot scrapers. In 2025, however, our clicks have held steady while our impressions cratered. We think this is in part because trust in our brand has skyrocketed in recent years as we’ve been the recipient of many prized awards such as the CCA, and Inc Magazine Inc 5000 (as well as one we’re just as proud of that will be announced in 3 weeks), and because as we noted many of the people who are renting homes this fall are sharp, decisive, value hunters who know exactly what they want.

We would like to think they want MoveZen to be their property manager, a company that understands the financial firepower that phenomenal tenants can deliver when pampered (as does Marriott’s management). They want to rent high-quality properties from great companies, not just anything that hits the market.

Fascinating Property Management Website Traffic Patterns from Our Rental Search Site in 2024

We recently noticed this fascinating chart of clicks to our website over the past 12 months or so. We often warn owners that it is imperative to have their rental filled by mid-July because traffic falls off dramatically at that point.

Then our marketing team stumbled on this fascinating chart that literally shows that issue front and center. Most of the visits to our site are renters searching for homes, and the drop off at mid-July is clear. In most years, but especially 2025, we recommend being rented by July 4th to be on the safe side, as often when the economy is volatile, the seasons get cut short.

Also note the increase at new years. That was the start of 2025 winter market and it was one of the strongest we’ve ever seen. Things have tapered off a bit but it was a great market for winter and that is clear in the chart as well.

You can also read details on other seasonal trends in this article: Understanding the Seasonal Dynamics of the Single-Family Rental (SFR) Market