As market shifts continue, it is crucial for property managers and investors to stay ahead. Federal Reserve Chair Jerome Powell warns that mortgages may soon become hard to obtain in parts of the U.S., and this could alter the real estate landscape significantly. Therefore, adopting new tactics and strategies is essential.

“If you fast-forward 10 or 15 years, there are going to be regions of the country where you can’t get a mortgage,” he said during his semiannual testimony to Congress, noting that banks and insurance companies have been pulling out of coastal and fire-prone areas they deem too high risk. See https://finance.yahoo.com/news/powell-predicts-a-time-when-mortgages-will-be-impossible-to-get-in-parts-of-us-190820841.html

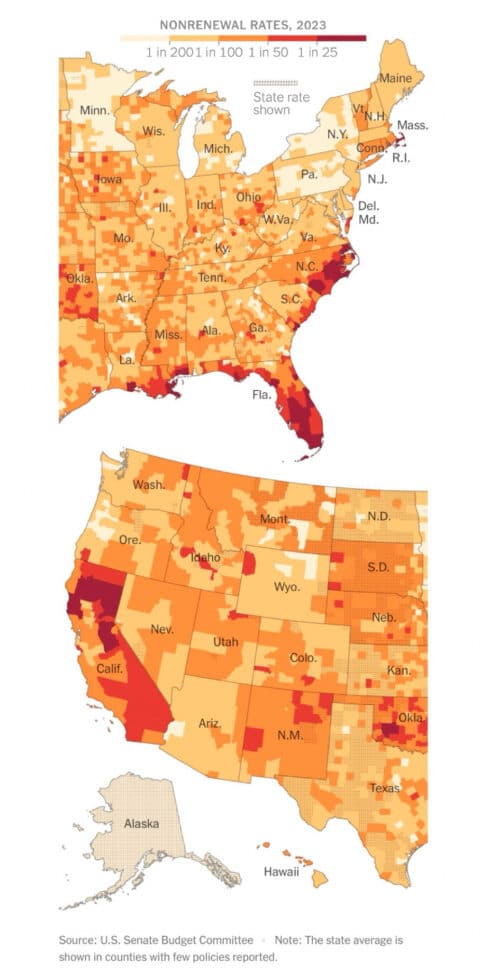

Unfortunately, this chart of 2023 Insurance Non-Renewal Rates Hits NC and SC Hard, and Has Incredible Implications that Don’t Seem to be Getting Necessary Attention

Rising Mortgage Restrictions and Their Impact on U.S. Real Estate

Powell’s comments indicate a possible future where traditional mortgage lending may dry up if inflation remains high and interest rates rise. Consequently, this scenario may lead to several outcomes:

Implications for Property Managers and Real Estate Investors

Given these challenges, property managers must adjust their tactics, and investors should diversify their financing approaches. For instance, focusing on the following strategies can be beneficial:

Make Your Home Stand Out With This Guide To Getting Perfect Rental Presentation Pictures

Strategic Tactics for a Tightening Mortgage Environment

Investors are encouraged to adjust their approach by adopting these tactical measures. First, improving operational efficiency through streamlined property management can boost margins while reducing dependence on external financing. Moreover, leveraging technology, such as data analytics and property management software, offers timely insights into market trends. In addition, targeting high-demand markets with lower vacancies and stable rents can help maintain strong returns. Finally, building robust local networks with lenders, brokers, and alternative financing partners will open creative funding solutions.

Get a Free Virtual Rental Evaluation Plus a Custom Cost Quote

Conclusion: Staying Ahead in a Changing Financial Landscape

In summary, Powell’s projections suggest that parts of the U.S. may soon experience mortgage constraints, and both property managers and investors must innovate and adapt accordingly. By embracing diverse financing options, enhancing operational efficiency, and utilizing market data, you can drive strong investment returns. Stay informed, be proactive, and position your portfolio for success—even in challenging mortgage conditions.