Introduction

If there’s one thing we’ve learned from nearly 20 years of pricing rentals daily across two states and seven major metros, it’s that the rental market is as unpredictable as it is fascinating. We’ve manually performed thousands of rental market estimates annually, and these predictions have had direct consequences for our success—success that includes an Inc. 5000 Regionals Award in 2020 and the prestigious Inc. 5000 award during the challenging COVID years of 2021-2023.

Listen to a podcast featuring this article.

Let’s talk about you—build-to-rent developers—and what you can learn from our roller-coaster ride through the rental markets of the past 20 years. Grab a cup of coffee, and let’s dive into the lessons that can help you navigate this complex terrain confidently.

The Art and Science of Rental Pricing

Walking the Tightrope Between Underpricing and Overpricing

Pricing a rental property isn’t just about crunching numbers; it’s about understanding people, markets, and sometimes even psychology, especially as property managers. Underprice the listing, and owners will think you’re undervaluing their precious investment. Overprice it, and you’re setting everyone up for a headache—your account managers, the owners, and ultimately, the bottom line profit for all.

Furthermore, we guarantee owners prior to sign up that if we can’t achieve the estimated range within a reasonable time, they can leave with no penalty. So we can’t play it safe and underprice or owners will not sign up, and we have to be extremely careful about overpricing as well. Despite that, we produce thousands of estimates a year, and hundreds of signups that we must perform for, and things run extremely smoothly. So smoothly that we were honored with the prestigious Inc 5000 award for the incredibly uncertain years from 2021 to 2023. We were also awarded the Inc 5000 Regional Award for the Mid-Atlantic in 2020, both of which are general national honors, not industry-specific.

Rare Rental Management Efficiency

In addition to unmatched rental market and price understanding, much of that success was a direct result of us sending 80% of every dollar we took in since 2020 to our owners, an astounding achievement in such a challenging environment, as well as one where many companies took advantage of consumers. Developers may recall the negativity and pain millions of residents and landlords experienced during those years. Despite all of that, our proudest achievement is that we’ve evicted just over 1% of our residents from the start of 2020 to the end of 2024.

Setting Rents is Easier with Build to Rent, but the Stakes are Higher

For build-to-rent developers, the stakes are even higher, but the process is quite a bit easier, especially if the floorplans are all the same. Data from one rental can be instantly applied to others and the process builds on itself. For MoveZen Property Management’s many mom-and-pop clients, each rental estimate is so unique there aren’t a ton of clear adjustments and lessons to be gleaned from failures and applied to future units. In every case, we have to make a custom assessment and deliver to tight tolerances. All this is to say that we know what renters want, what they think, and what they will pay and stay for better than any property management company in the country in our opinion.

Lesson for B2R Developers: Don’t obsess over squeezing every last dollar out of rental rates. Focus on attracting high-quality residents who will stay longer, take better care of the property, and ultimately contribute more to your net operating income (NOI). Remember, vacancy is the silent profit killer.

The Psychological Price Points

In 2024, we’ve observed something fascinating—rental pricing gravitating around big, round numbers like $2,000, $2,500, and $3,000, have proven to be a battleground, as if renters and owners have a psychological barrier when it comes to crossing these thresholds.

We’ve often seen investors stubbornly stick to $2,100 instead of dropping to $1,999, even when we strongly advise that $2100 will leave their property sitting vacant for months. It’s a classic case of being penny-wise and pound-foolish. Dropping the rent by just $1200 a year ($100 per month) could double their traffic overnight.

A Quick Math Example:

Scenario A: Rent at $2,100 with a 3-month vacancy.

Scenario B: Rent at $1,999 with immediate occupancy.

Difference:

Scenario B earns $5,088 more annual revenue despite the lower monthly rent. However, owners who land in scenario A tend to reach for a resident who will pay and concede credit or income quality instead. That increases the odds of all kinds of problems dramatically. Turnover is likely to be quite a bit higher with A as well and in today’s high-cost, high-risk (fraud, etc) turnover is the second most insidious problem for rental investors after vacancy.

Lesson for B2R Developers:

Never forget that great residents have great finances for a reason, they find value. Unless your property is extremely special you rarely get a significant premium without taking on significant risk. Be flexible with your pricing, especially around psychological thresholds. A small concession can lead to significantly higher occupancy rates and, consequently, better annual returns.

The Tale of Johnny and Sally’s Lemonade Stand

At one point before falling rents were very well publicized we considered sending our clients a memorable third-grade math problem:

“If Johnny tries to sell his lemonade for $8 a glass when Sally is selling hers two blocks away at $6 a glass and it’s the same (or maybe better), how many glasses of lemonade will Johnny sell?”

The answer is obvious—Johnny will be broke, and Sally will be laughing all the way to the bank. Our PR team advised against sending this out (probably a good call), but the lesson remains.

Lesson for B2R Developers:

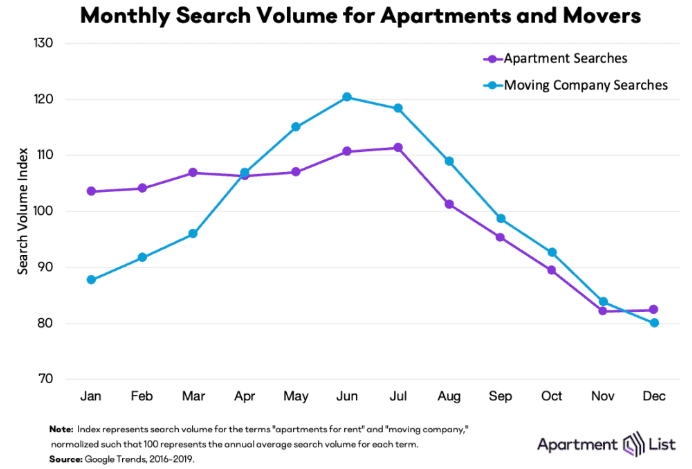

Ignoring market realities (a shockingly common reality) because of your costs or desired profit margins doesn’t change the market. Pricing competitively is crucial, even if it means adjusting your expectations. Rental markets in the US are very efficient with a few seasonal exceptions where we do tend to see consistent premiums paid even by higher quality residents, and we heavily target those periods (March-June and late October to early December).

Understanding Renter Psychology

Renters Are Extremely Practical

Renters, by and large, are a practical bunch. They’re looking for value, convenience, and a place that feels like home without breaking the bank.

Common Mistake:

Some rental investors think they can pass on their increased costs directly to renters by rolling costs (including poorly planned investment and renovation decisions) into the rent. Unfortunately, renters have other options and will choose a more affordable alternative if available, and there usually is. The problem here is that rental investors have a tendency to focus on themselves, not the renters in their market. It often occurs first when they purchase the property, again when they price the listing, and finally on lease terms.

Especially since 2023 many investors take it a step further and feel it is their right to directly pass increasing ownership costs on to renters who do not enjoy the investment, tax, or appreciation benefits that owners are often ignoring. First as noted these markets are efficient, all owners are facing those challenges, and it’s all priced in before we or an investor determines the expected rental range. So tacking on $100 a month because your HOA dues went up is directly overpricing the unit by $100, especially if it puts you over those large round numbers like $2,000.

Have a Mindset of Abundance, not of Scarcity

These owners often have a classic scarcity mindset, not an investor’s mindset of abundance, and they tend to get the worst results in the industry. Instead of obsessing about getting that $100, owners should obsess about getting historically high rent income flowing as fast and for as long as possible. When you do that it makes up about 80% of your total performance and that $100 is a small cost of doing business. That’s how investment works. You may be tempted to say I’m a sophisticated investor I wouldn’t make those rookie mistakes but in our 20-year experience, a shocking number of larger portfolio owners cling to these ideas the hardest.

Proverbial Wisdom:

“One day, a poor villager happens upon a magic-talking fish that is ready to grant him a single wish. Overjoyed, the villager weighs his options. As he’s about to decide, the fish tells him that whatever he gets, his neighbor will receive two of the same. Without skipping a beat, the villager says, ‘In that case, please poke one of my eyes out.’”

Don’t be the villager who harms himself just to avoid letting someone get a deal at your expense. Focus on your own success by understanding and catering to renter needs.

Lesson for B2R Developers:

Align your offerings with renter priorities. Practical amenities and fair pricing will attract high-quality, high-rent-paying tenants more effectively than trying to maximize rent at the expense of occupancy.

Amenities That Make a Difference

The Power of the Washer and Dryer

You might think a washer and dryer are minor details, but they’re often deal-breakers. In fact, they are consistently among the top three most requested amenities by renters nationwide. The bottom line is that having to provide your own washer and dryer is a massive hassle for the vast majority of renters and they will consistently demand a lower rate to deal with it. Sometimes 15% lower.

Put Yourself in 25 Year Old Shoes

Imagine being a 25-year-old these days and you just paid $6000 to get moved in (deposit rent fees), and you also have to rent a set at $200 a month or buy one for $1200. Then you often have to lug it up the stairs and deal with it when you move in a year. It is a guaranteed bad idea not to include a washer and dryer with the only serious exception being high-end homes usually well over $3000 a month for various reasons. Many owners also fear that will increase flood risk but it’s just the opposite. Most of our washer floods have occurred due to poor hoses or more common cross-threading supply lines on installation. Both are much more likely if the 25-year-old just bought them on Facebook. We had one that didn’t know the washer had to drain and just left the hose on the ground.

Why It Matters:

Data Point: According to a survey by the National Multifamily Housing Council, 91% of renters consider in-unit laundry facilities a primary need.

Lesson for B2R Developers: Including washers and dryers isn’t just a nice-to-have; it’s a must-have in most markets. It’s a small investment with a significant return.

Fenced Yards: An Investment Worth Making

Fences offer privacy and security, two things renters value highly. Yet, many property owners overlook this feature.

Benefits:

Cost-Benefit Analysis:

You also have to consider the massive tax savings, reduced vacancy and higher tenant satisfaction, increased resell value, better refinance prospects, etc, and the investment pays off dramatically quicker. In many cases when we do rental estimates a dozen homes will be going nowhere at $2000 and one that is almost identical will be off the market in 2 weeks at $2200.

Lesson for B2R Developers: Plan for fences in your developments, in our view it’s almost always a mistake to forgo them on single-family units.

Outside Storage: The Unsung Hero

Storage space is often overlooked but is a significant factor for renters. Whether it’s an outdoor shed or an attached storage closet, extra space can set your property apart, particularly if you don’t have a garage.

Why It Matters:

Pet Policies: Embracing Furry Friends

The Pet-Friendly Advantage

Allowing pets isn’t just about being kind-hearted; it’s a strategic business decision. Approximately 70% of U.S. households own a pet, according to the American Pet Products Association. Some markets are pushing 80%.

Benefits:

Addressing Concerns:

Lesson for B2R Developers: Embrace pet-friendly policies to attract a broader audience and improve your bottom line. The benefits often outweigh the potential downsides.

Presentation Matters: Don’t Cut Corners

First Impressions Count

In 2024, renters have access to countless listings at their fingertips. High-quality photos, detailed descriptions, and professional presentations aren’t optional—they’re essential.

The Difference Maker:

Lesson for B2R Developers: Invest in professional marketing for your properties. A well-presented listing attracts more interest, leading to faster rentals and better tenants. Do not cut corners on presentation at all.

Including Utilities and Services: A Double-Edged Sword

The Pitfalls of Bundling Costs

Including utilities or services like lawn care in the rent might seem like a value-add, but it can backfire.

Considerations:

Lesson for B2R Developers: Unless it’s a common practice in your market, think twice before bundling additional costs into the rent. It might not yield the benefits you’re expecting.

Embracing a Mindset of Abundance

Focus on Net Operating Income (NOI)

At the end of the day, what matters most is your NOI, not just the top-line rental rate. Holding out for higher rent while your property sits vacant is counterproductive.

Think Long-Term:

Lesson for B2R Developers: Adopt an abundance mindset. By focusing on providing value to renters, you’ll attract quality tenants and improve your overall returns.

Conclusion

Building a successful build-to-rent community isn’t just about bricks and mortar; it’s about understanding the people who will call it home. By focusing on renter psychology, practical amenities, flexible pricing strategies, and high-quality presentations, you can create a community that’s both profitable and sustainable.

Remember the lessons from our decades of rental pricing experience:

By keeping these principles in mind, you’ll be better equipped to navigate the challenges of the rental market, attract high-quality tenants, and achieve long-term success.

And hey, if you ever find yourself considering poking your eye out just to spite your neighbor, maybe it’s time to revisit your strategy.

Stay practical, stay flexible, and enjoy the amazing benefits of being a build-to-rent developer.