Apply Here

Apply For a MoveZen Managed Rental Home

If you’re just beginning the process, you should pay the $89 application fee below first, and you’ll be forwarded to the page to submit your background information after payment

Equal Opportunity Housing Provider

The Apply Now Button is Near the Bottom Because These Terms are Crucial to First Understand.

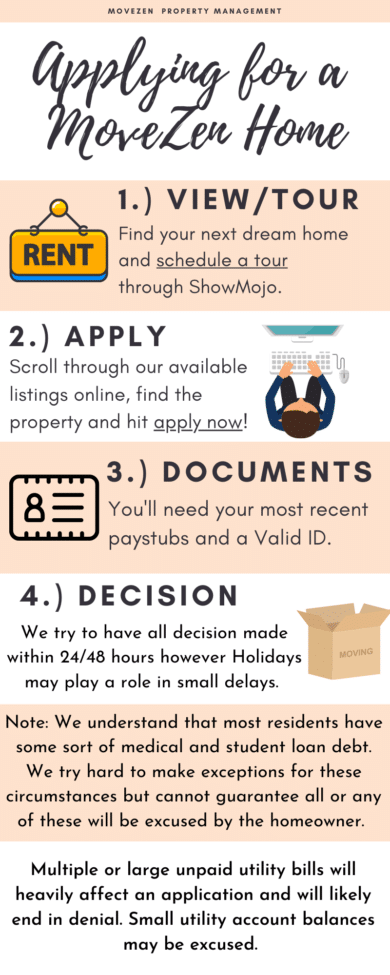

Step by Step Through Our Application Process

Before applying it would be good to review the following items.

1. Rules of the Road : A pdf handout that walks through the important issues to know before deciding to apply, how the process flows from there, and what to expect from us long term. This outlines the most common policies we need to cover early on, and gives you insights into how our company operates. You can find much more on our knowledge base because we’ve invested significant resources in being as transparent as we can be (due to federal law we are extremely limited regarding credit decisions) and providing you the most useful tools available.

2. Application Overview:

Skip to Apply Now (select the specific property and if posted, it is 90% likely to be still available to rent).

Unfortunately, much of the cost and headache with modern rental application procedures is due to an explosion in sophisticated application fraud that truly hurts everyone involved with rentals. We are no longer able to accept credit reports with less than 2, 3-year+ old items on them, very little activity despite being years old, or less than 2 years old. Because it’s usually fraud, we can’t even accept cosigners. Someone living in the home will have to have an active credit profile we can definitively verify every time. The latest fraud almost always involves one or two minor good-standing credit items with small or no balances. They have little activity overall, but decent scores. Because we estimate that 85% of these applications are fraudulent from the beginning, we can no longer accept them.

Because many fraudulent applications are also accompanied by fraudulent IDs, if we can definitively verify your identity through a third party, we will attempt to move forward, though little credit is still a challenge for most of our properties. The owner also may consider cosigners. Being listed on a third-party directory, for example. University, established company website, and other similar sites.

Income Verification

We’ve also dramatically increased our income verification requirements, and that means if we cannot directly verify your income with an established 3rd party, we will require an additional $20 payment and you will have to sync your online bank logins with the same major public credit processing agency being used for the background check. Find the latest on them at the bottom of the page here. for fraud-proof income verification. It’s getting to be common and is performed by a major public company.

Most of the largest companies in the country do not directly verify income, and this added requirement and $25 cost will be required.

All applicants must make a minimum of 3X the monthly rent. Meaning if the home available is currently renting for $1500 a month, the total income for all applicants for that home must be $4500 or greater per month.

General Acceptance Process Information

We begin our assessment with the credit score but consider other factors, many of which are noted here. A credit score over 750 will warrant acceptance in most cases. Unpaid utilities are heavily weighted and will typically result in being declined, especially for higher-end homes. Habitual late payments for utilities are also considered to be a sign of higher risk.

We advise owners that medical collections or education loans rarely indicate a high risk of non-payment for rent. We encourage owners to apply minimal to no weight when these issues arise. Largely due to their strict repayment requirements, education loans must be considered, however, we encourage owners to weigh these issues lightly when considering the risk of acceptance. Having a high level of additional debt increases the risk.

Additional Funds

One common method we use to motivate owners to accept someone with less than stellar credit is to collect the last month’s rent. This is not always available, but has been helpful for many owners and tenants. Doing this dramatically lowers the risk for the owner and is also a great approach when someone has the ability, since you may get a prized home, and your next move will be much easier since you won’t have to pay the last month.

Cosigners and Past Evictions

Not all owners accept cosigners. Even with a cosigner, the residents living in the home still must pass basic background screening, reference checks, etc. Past evictions are almost a guarantee of non-acceptance. Our records only go back 10 years, so if you were evicted long ago, it won’t apply. If there is some legal documentation you feel may warrant reconsideration, we’ll take a look, but you will most likely lose the application payment.

Tips

The more detailed and honest you are with your application, the faster we will be able to reach a decision. Feel free to attach additional information as well. You’ll need to provide a valid form of identification and proof of income.

We do not process any part of an application until all parties have submitted and paid their portion.