January Home Sales Tank 8.4% as NAR’s Chief Economist Declares a “New Housing Crisis.” For Rental Investors, the Playbook Is Clearer Than You Think.

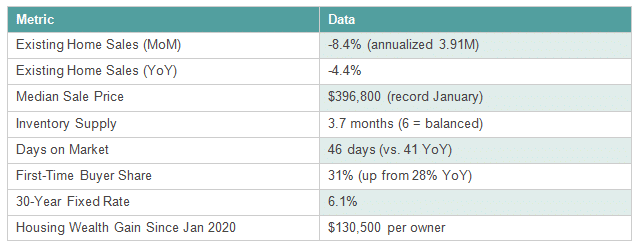

Lawrence Yun does not use the word “crisis” lightly. The NAR’s chief economist has been carefully optimistic for the better part of three years, threading the needle between sobering data and the industry’s insatiable need for silver linings. So when he looked at January’s numbers and called this a “new housing crisis,” it landed differently than the usual talking-head commentary. Sales of previously owned homes dropped 8.4% from December to a seasonally adjusted annualized rate of 3.91 million, the slowest pace since December 2023 and the steepest monthly decline since February 2022. These closings represent contracts signed in November and December when mortgage rates barely moved. In other words, this is what the market looks like even when rates cooperate.

The median sale price hit $396,800 in January, a record for the month and up 0.9% year over year. But prices are doing all the heavy lifting while volume collapses underneath them. That is an unsustainable dynamic and we’ve been warning about it for years. Yun himself summed it up best: “The movement is not happening. Americans are stuck.”

We agree with his diagnosis. We disagree on why it needs to be a crisis for everyone. For property owners willing to think clearly about their options, this environment is creating some of the best rental market conditions in a decade. For those who own a home they can’t or won’t sell right now, the situation is even more nuanced, and the math might surprise you.

The Sales Market Is Broken. The Rental Market Is Not.

Here is a claim you will not hear from the real estate sales industry, because it runs counter to their financial interests: for many current homeowners, the smartest financial move right now is not to sell at all.

Consider the math. The average homeowner sitting on a sub-5% mortgage rate from 2020 or 2021 is holding one of the most valuable financial instruments available to a retail investor. Meanwhile, selling into this market means competing for a shrinking buyer pool (January sales fell most sharply below $250,000), paying 5-6% in transaction costs, and then reinvesting at current prices and rates. The only price segment that posted positive year-over-year sales growth was the $1 million-plus range, which tells you exactly who still has the confidence and capital to transact.

Meanwhile, inventory rose 3.4% year over year but remains far from balanced at 3.7 months of supply. Homes are taking 46 days to sell versus 41 a year ago. That is heading in the wrong direction for sellers, particularly in the South and West where the declines were sharpest.

January 2026 Housing Snapshot

Option One: Convert to a Long-Term Rental and Let Your Asset Work

We’ve managed rental properties across seven Sunbelt metros for nearly two decades now, and the single most consistent pattern we see is owners leaving enormous amounts of money on the table because they default to selling when they should be renting. The reasons vary, but pride, lack of information, and inertia top the list every time.

Here is the uncomfortable truth the sales industry does not want you to hear: a typical homeowner who accumulated $130,500 in housing wealth since January 2020 (Yun’s own figure) stands to surrender $24,000 to $35,000 of that in transaction costs, staging, repairs, and carrying costs during an extended sale in this sluggish market. That is before the tax implications of realizing gains. Meanwhile, a well-managed rental in most of our Sunbelt markets generates $1,400 to $2,200 per month in gross rent. At the low end, that is $16,800 per year in income while your asset continues to appreciate, your mortgage gets paid down by someone else, and your sub-5% rate keeps compounding in your favor.

We are not saying every home makes a good rental. Some do not, and we are transparent about that. But the math favors renting over selling in this environment far more often than most owners realize, particularly when the alternative is a home sitting on the market for 46+ days bleeding carrying costs with no income at all.

The Myths That Cost Owners the Most

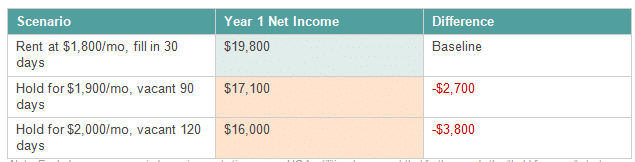

“I’ll attract bad residents if I price competitively.” FALSE. Great residents by definition have strong finances and make smart money decisions. They find value and move fast. The data is clear: competitively priced homes attract higher-quality applicants, lower vacancy rates, and dramatically better long-term Net Operating Income. High credit quality earns low rates on everything, including rent. It is the overpriced homes that sit vacant and eventually attract the desperate applicant willing to overpay, which should concern you far more.

“It’s cheaper to let the home sit empty than accept a lower rate.” FALSE. Vacancy in our markets runs $60 to $100 per day. An owner who waits two months for a “better market” has burned through $3,600 to $6,000 in lost income. That same owner almost always ends up reducing the rent by 10% or more anyway. It is the definition of a lose-lose outcome. Vacant homes also require more maintenance. When HVAC systems and water heaters sit underutilized, they are dramatically more likely to fail during a move-in, especially in extreme weather. We do the vast majority of our maintenance at move-in and very little afterward when a quality resident is in place.

“I should wait until the market recovers to rent.” FALSE. In nearly two decades of doing this, we have watched this mindset destroy more Net Operating Income than any other single factor. The market rarely “comes around” in time. Professional managers accept strategic vacancy costs in very specific situations, but that knowledge comes from being in the trenches every day, not from gut feelings or wishful thinking.

The Real Cost of “Waiting for a Better Market”

Our consistent approach is to price competitively from the start and then apply systematic, small price reductions that generate thousands of email notifications to every person who has shown interest in the property. When someone who’s been watching a listing sees two price reductions in 20 days, it engenders urgency and a fear of missing out. We have used this method to phenomenal effect for nearly two decades. Even a $50 reduction triggers a wave of interest, and for homes under $1,000 a month, a $15 reduction is remarkably powerful.

Option Two: Professional Vacant Home Care While You Wait

Not every owner is ready to rent. Some are navigating a family estate. Some have relocated and plan to sell when conditions improve. Some are sitting on a home they inherited and simply haven’t had time to figure out the right path forward. Yun’s data shows this is happening at scale: with sales volume at its lowest in two years and homes taking longer to move, the number of Americans simply sitting on vacant property is growing fast.

Here is what most of those owners do not fully appreciate: a vacant home is an actively depreciating asset. Not in the accounting sense. In the literal, physical, problems-compounding-daily sense. HVAC systems that do not run regularly fail faster. Plumbing that does not flow develops issues. Minor leaks that a resident would notice in hours go undetected for weeks. Pest infestations establish themselves in empty homes with alarming speed, particularly in Sunbelt climates. We have seen owners return to find $15,000 to $25,000 in damage that started as a $200 problem three months earlier.

This is where our Custom Home Services division fills a gap that the market badly needs. Whether you’re between selling and renting, managing an inherited property from another state, or maintaining a second home you visit seasonally, our operations team provides systematic property oversight that prevents the small problems from becoming financial disasters. Regular visits, HVAC cycling, plumbing checks, exterior inspections for water intrusion and rot, pest monitoring, and the kind of attentive care that keeps your largest asset protected while you make your next move on your timeline.

The cost of professional vacant home care is a fraction of the cost of the repairs that neglect creates. It is also a fraction of the carrying costs you are already absorbing on a home producing zero income. Think of it as insurance that actually works, except instead of fine print designed to deny your claim, you get a field team with boots on the ground and a nearly two-decade track record of protecting assets.

The Bigger Picture: Why This “Crisis” Favors Patient Capital

Yun noted that affordability conditions are actually improving, with housing the most affordable it has been since March 2022 due to wage gains outpacing home price growth and rates sitting lower than a year ago. That is significant context. The problem is not affordability in isolation; it is the psychological paralysis created by years of volatile conditions. Buyers are frozen. Sellers are frozen. First-time buyer share inched up to 31% from 28%, but that still means nearly 70% of transactions involve existing homeowners playing musical chairs.

For rental property investors, this paralysis is structurally positive. Every potential buyer who stays on the sidelines remains in the rental pool. Every homeowner who cannot sell at their desired price is a potential conversion to rental investor. Every month that transaction volume stays depressed is another month that rental demand stays elevated, particularly in the growing Sunbelt metros where job creation continues to outpace the legacy coastal cities.

The FED has been explicit about targeting shelter inflation as a key component of their monetary policy framework. This targeting strategy has cooled the top-line rent growth that defined the COVID era, which is healthy. It’s done nothing to address the fundamental supply shortage that keeps occupancy rates high and provides a durable floor under rental income. At 3.7 months of for-sale inventory, the market is nowhere close to the 6 months that would signal equilibrium. That supply gap does not resolve in a quarter or even a year. It resolves over a decade of sustained building, which faces its own headwinds from labor shortages, material costs, and increasingly restrictive local zoning.

What We’d Tell You Over Coffee

If you own a home you are considering selling in this market, take a hard look at the rental math first. A $400,000 home generating $1,600 per month in rent while your 3.5% mortgage gets paid down by your resident, your asset appreciates at even modest rates, and you collect favorable tax treatment is a financial machine that most sellers willingly dismantle for a lump sum they then struggle to redeploy effectively.

If you are not ready to rent, do not let your vacant home sit unattended. The carrying costs are already painful. The preventable maintenance disasters that compound in empty homes can turn a manageable situation into a financial emergency. Professional oversight costs a fraction of what it saves.

Not All Bad For Investors Who Are In It For the Long Haul

If you are already a rental investor, this market environment is your friend if you are disciplined about pricing. Quality residents are out there in force. Many are highly qualified people who simply cannot or will not buy in this market. They are looking for well-maintained homes at fair prices, and they tend to stay longer, pay more reliably, and care for your property better than the desperate applicant willing to overpay for an overpriced listing.

As Yun said, Americans are stuck. That is real, and we take no pleasure in it. But “stuck” does not have to mean “powerless.”Owners who will look back on this period five years from now with satisfaction are the ones making clear-eyed decisions today, anchored in data rather than emotion or pride. We’ve spent nearly twenty years helping property owners do exactly that, and this is the kind of environment where that experience compounds most dramatically.

Read more: January home sales tank more than 8% with potential buyers struggling