2025 was the worst year in rentals that we’ve seen in at least 15 years, and next year will mark our 20th anniversary. If you’re a landlord / rental investor in North Carolina or upstate South Carolina, especially around Raleigh (RDU) and Charlotte (CLT), you’re probably feeling a bit blindsided right now. We get it. For a long time, the market grew every year, and began to roar through the pandemic with rents shooting up, tenants lining up, and even questionable homes flying off the market.

But here we are at the tail end of 2025, and things have dramatically changed. Let’s break down why owners with vacancies in early 2026 must accept the new realities and make the case for pricing your rental aggressively, even if it stings a lot.

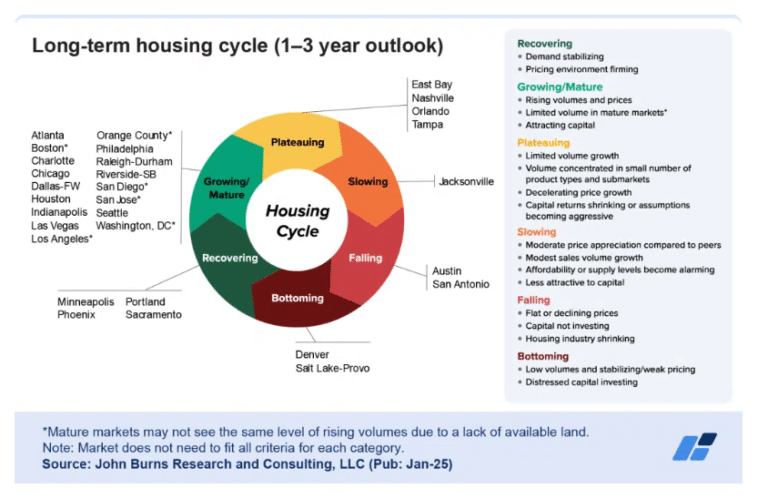

1. Data Doesn’t Lie: Raleigh and Charlotte Are Leading… In the Wrong Direction

Take a look at the apartments.com National Rent Trends Report. Raleigh and Charlotte, our beloved growth engines, are now near the bottom of the national rent growth chart. Literally some of the weakest rent performers in the entire country.

When Charlotte and Raleigh slow down, the rest of the region feels it too.

2. It’s Not Just You—Rents Really Are That Low

For those who feel like “Is it just me, or are rents actually down compared to last year?” No, it’s not just you. National rent growth has cooled almost in all markets since 2023, but our local markets in NC and upstate SC are feeling it harder than most and that is well documented.

Also painful is the fact that this year is shaping up to be that rare moment when sluggish home sales didn’t translate into hot rental demand. Usually, if people aren’t buying, they’re renting. Not this time.

Rents aren’t rising to meet mortgage payments. Demand’s not keeping up with new supply, especially in spots where investors have been piling in and developers have built like there’s no tomorrow.

3. Vacancy: The Silent (But Deadly) Killer of Landlord Returns

We consider vacancy to be the most insidious cost the average single-family landlord faces, and it’s often their largest expense in a move-out year. A tragedy in our view because no one benefits from a vacant home. At least with a reduced price, you quickly fill the home with a deserving high-quality resident who’ll maintain it to some degree and generate significant albeit discounted income. We liken the issue to the old fable of the tortoise and the hare. In a tough market, the slow and steady strategy tends to trounce the ones that focus on top line rate.

There’s a reason industry pros call it the “black hole” of real estate returns. If your property’s sitting empty, even for just a month or two, you’re not only losing out on rent, but you’re racking up carrying costs (mortgage, taxes, insurance, maintenance, utilities), and your overall return for the year takes a nosedive.

If you think of your net annual performance as a pie made up of revenue vs expenses, revenue makes up about 80% of the pie for our customers. All other combined costs other than vacancy account for 20% of the pie (approx 10% repairs and 10% management). If income (80%) is flowing, the costs (20%) are extremely manageable. For every month a rental is vacant you reduce revenue (80%) by 8%. This resizes the pie dramatically against you.

Let’s Talk Numbers

Plug your numbers into MoveZen’s Rental Vacancy Cost Calculator if you haven’t already. Here’s a simple example for a single-family landlord in Raleigh:

Scenario A: Hold the line (2 months vacant, get $2,000/mo)

Scenario B: Slash price (rented immediately at $1,850/mo)

Difference: $5,200. That’s the cost of just 2 months vacant. And if you wait longer, it gets worse. The calculator lays it out in even more painful detail, so don’t skip it.

And if your property’s already been empty for a month or two? It’s not “just a blip.” You can’t make it back by asking for more rent later, tenants simply have too many choices right now.

4. Why This Year, and Maybe Next, Are Different

Every seasoned landlord knows markets have ups and downs. Normally, you’d expect that when home sales slow down (like they have in 2024-2025), rental demand goes up. But with record-high new apartment completions, investor-owned homes, and a lot of people finally moving out (yes, even from Charlotte and Raleigh), demand just isn’t keeping up.

Some of this is temporary:

But there are also some longer-term trends at play:

Our Prediction? Next Year Might Be Even Tougher

We wish we could say, “Hold out, the cavalry’s coming!” But all signs point to at least another year of weak rent growth, high inventory, and picky tenants. Locking in even a slightly discounted lease now, ideally 14-16 months could be a win because it would bridge two winter seasons. It’ll let you ride out the storm and avoid the chaos of trying to rent again next spring when you’ll be competing with every new building in town.

5. Why Single-Family Landlords Need to Be Especially Aggressive

Look, apartment owners are used to competition—they have leasing teams, concessions, and incentives dialed in. Single-family landlords? Not so much. Most owners have one or two homes, aren’t full-time pros, and can be more emotionally attached to “what the house should rent for.” That’s risky thinking right now.

Landlords Struggle to Properly Account for Vacancy Cost:

All that means you can’t “wait for the right tenant.” The right tenant is the one who’s ready to move in now and pays every month.

6. Pricing Aggressively Is Not Surrender, It’s Smart Business

It’s tempting to think, “I’ll just hold out for one more week, maybe next month will be better.” But when vacancy is eating your returns alive, every week you wait is a week you’re falling behind.

A few smart moves:

7. The Insidious Nature of Vacancy (Especially When It Feels Temporary)

Here’s the kicker: vacancy feels like a minor setback “just a month or two.” But once you factor in all the lost rent, added wear-and-tear (yes, empty homes get weird issues), security risks, and missed tax deductions, you realize how damaging even short vacancies can be.

Vacancy is like a silent drain on your investment. It’s not as obvious as a big repair bill, but it quietly wrecks your annual return and puts you behind for years. For single-family landlords, this is especially brutal. Most don’t have enough cash flow or multiple properties to weather a long dry spell.

8. The Bottom Line: Get Real, Get Rented

We feel your pain literally because our business is almost completely based on those top line revenues. It’s never fun to lower your rent expectations, especially after such a wild ride these last few years. But the data’s clear, and the market’s telling you what it wants: affordable, flexible, well-maintained homes now.

So, if your home’s been sitting, don’t wait. Cut the price, sweeten the deal, lock in a long lease, and get someone in there. Your future self (and your bottom line) will thank you.

And hey, you’ll sleep better at night knowing your investment isn’t quietly bleeding you dry.

Need help? Want a second opinion on your pricing? Just want to vent? We’re here for that too. Reach out, check your numbers, and let’s get your place rented before vacancy chews up any more of your return.

Final Thought: In real estate, waiting for “what should be” is the quickest way to lose out on “what is.” Don’t let your rental be the one folks scroll past while you chase last year’s prices. Get aggressive, get real, and get it rented.